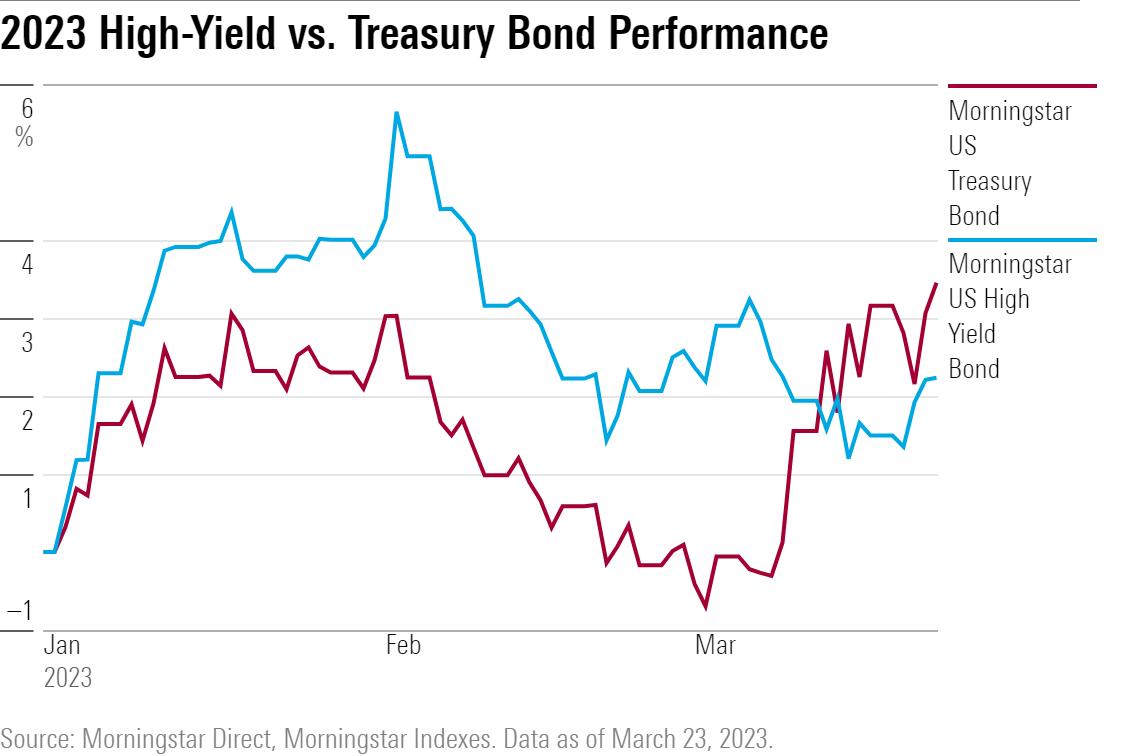

With the collapse of Silicon Valley Bank SIVB sparking fears of a broader banking industry crisis, there’s been a sudden divergence in performance within the bond market.

High-quality bonds, including US Treasuries, have surged in price while lower-quality, higher-yielding assets are falling.

“There’s a credit event on the horizon, and people are worried about what’s ahead,” says Alfonzo Bruno, associate portfolio manager for Morningstar Investment Management.

For example, since March 8, as the news from Silicon Valley Bank began to emerge, the Morningstar US Treasury Bond Index has gained 3.7% while the Morningstar US High Yield Bond Index—which tracks riskier corporate bonds—has fallen 0.7%.

The rally in Treasury bond prices has led to a significant drop in yields. On the US Treasury 2-year note, the yield has fallen to 3.76% from 5.05% on March 8, hitting its lowest level since September 2022.