2024 Stock Market Outlook Key Takeaways

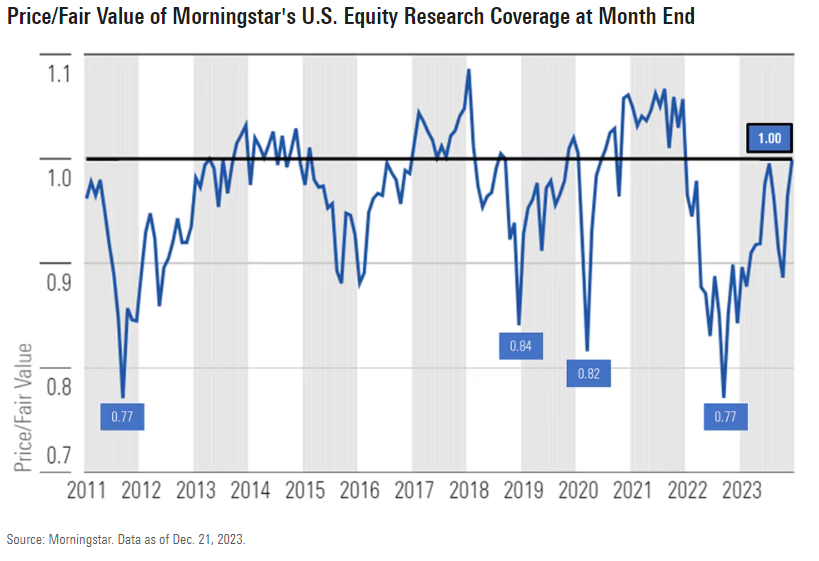

- The US stock market is now trading equal to a composite of our fair value estimates.

- Value stocks and small-cap stocks still trade at attractive discounts.

- The technology sector moved back to a choice for underweighting along with industrials, whereas communications, basic materials, real estate, and utilities are attractive overweightings.

- The rate of economic growth is forecast to slow in 2024, but no recession.

As long-term interest rates rose and the 10-year US Treasury bond neared 5% last fall, stocks sold off, dropping well into undervalued territory. However, this year’s “Santa Claus Rally” came early as long-term interest rates subsided in November and then the rally was boosted even further following the December Fed meeting. The market interpreted Federal Reserve Chair Jerome Powell’s remarks to indicate that not only is the Fed done hiking rates, but it is also now considering when to begin easing monetary policy.

According to a composite of the over 700 stocks we cover that trade on US exchanges, as of Dec. 21, 2023, the US equity market was trading at a price/fair value of 1.00, meaning that the market is equal to a composite of our fair value estimates.