One of the most important market relationships again works in investors’ favor.

After an abysmal performance for the 60/40 stock and bond portfolio mix in 2022, bonds are back and keeping portfolios afloat during stock market declines.

The 60/40 portfolio—a classic diversification strategy comprising 60% stocks and 40% bonds—assumes stock prices and bond prices tend to move in opposite directions. So when stocks fall, bond prices should rise and help smooth out a portfolio’s returns. Even for investors who don’t have a strict 60/40 strategy, the relationship between stock and bond prices is a critical foundation of just about any broadly diversified portfolio.

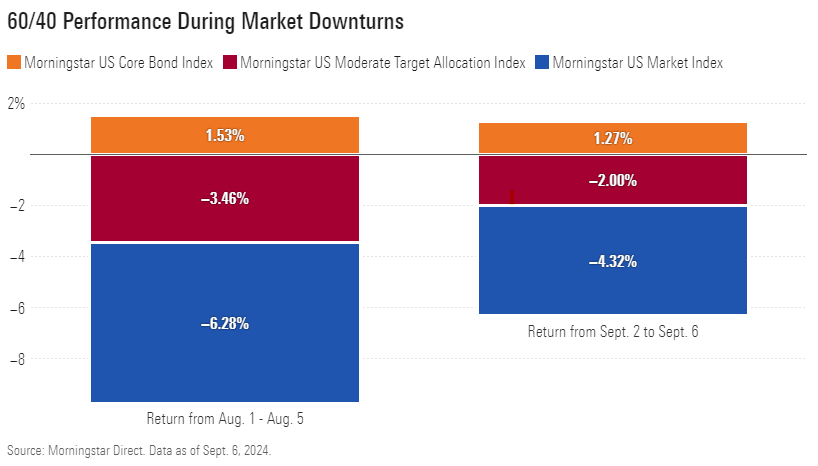

Take the third quarter, when the strategy worked well for investors. From Aug. 1 to Aug. 5, the Morningstar US Market Index fell 6.28%, but the Morningstar US Core Bond Index was up 1.53%. Similarly, from Sept. 2 to Sept. 6, stocks were down 4.32% while bonds were up 1.27%. As a result, 60/40 portfolios fell only half as much as the overall market. “Diversification is back,” says Morningstar Indexes strategist Dan Lefkovitz.

Looking more closely at recent one-day returns, this trend largely holds. Since the start of the third quarter, stocks and bonds moved in opposite directions on the same day 43% of the time. 34% of the time, they ended the trading day up. Only 23% of the time did they fall on the same day.