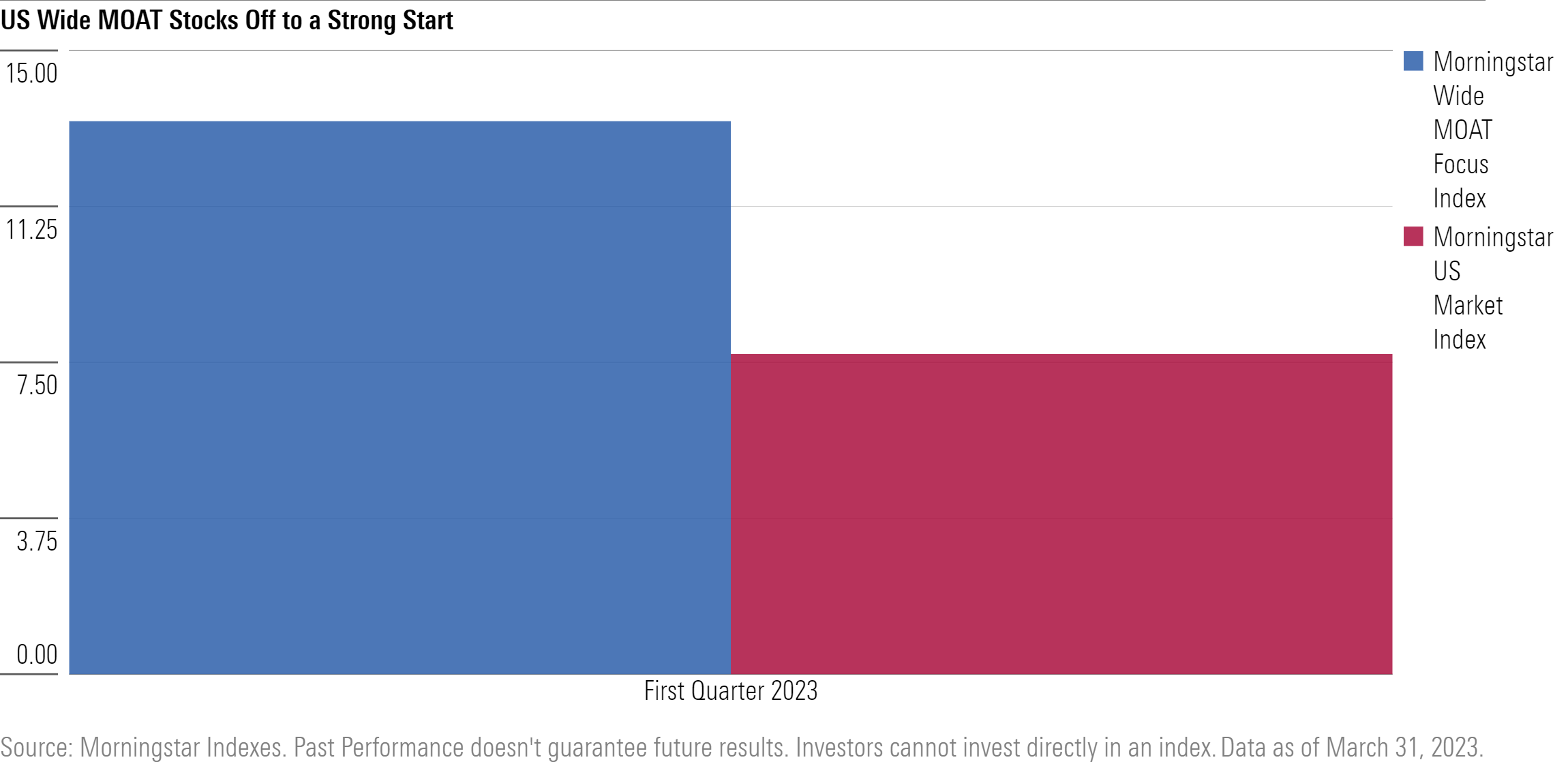

The Morningstar Wide Moat Focus Index rose 13.8% in the first quarter versus a 7.7% return for the broadly diversified Morningstar US Market Index. The outperformance of the US Moat index relative to its benchmark represents the highest single quarter outperformance in the history of the index.

Favorable performance is nothing new for US wide moat stocks. The Morningstar Wide Moat Focus Index posted average annual returns of 22.8%, 14.5% and 14.4% for the three-, five- and ten-year time periods ended April 3, again outperforming the US Market Index which posted 20.1%, 10.8% and 12.0% returns for the same time periods.

With about 50 total constituents, the Morningstar Wide Moat Focus Index is designed to provide relatively concentrated exposure to US stocks that Morningstar Equity Research believes have strong business models and lasting competitive advantages, identified as “wide” by the Morningstar Economic Moat Rating, and are trading at an attractive price relative to fair value.

Andrew Lane, Director of Equity Research, Index Strategies at Morningstar:

“The Morningstar Wide Moat Focus Index draws on the research and analysis of the Morningstar Equity Research Team. Thanks to its disciplined methodology, the Index has provided downside protection amid market downturns but has also outperformed to the upside over the long-term. For example, the index declined 13.1% in 2022 as compared to a 19.4% decline for its broad US market benchmark. However, it has rebounded more sharply than its benchmark in the first quarter of 2023.”

Brandon Rakszawski, VanEck ETFs:

“The Morningstar Wide Moat Focus Index has proven itself time and again as an attractive core US equity strategy with a propensity to outperform over long periods of time. Its ability to target attractively priced wide moat companies through market uncertainty has often position the index for potential success, as was the case in 2022 and thus far in 2023. Out clients continue to benefit from this simple yet effective index-based investment approach.”

©2023 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Morningstar, Inc. is not affiliated with Van Eck. Van Eck's products are not sponsored, endorsed, sold or promoted by Morningstar, and Morningstar makes no representation regarding the advisability of investing in any Van Eck product.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.