The Takeaway

The third quarter of 2025 marked a policy pivot by the Federal Reserve, which shifted its focus toward sustaining economic growth over curbing inflation, by reducing the federal funds rate by 25 basis points.

Shorter-maturity Treasury yields declined by an average of 35 basis points, while longer-maturity yields decreased more modestly, falling only 8 basis points.

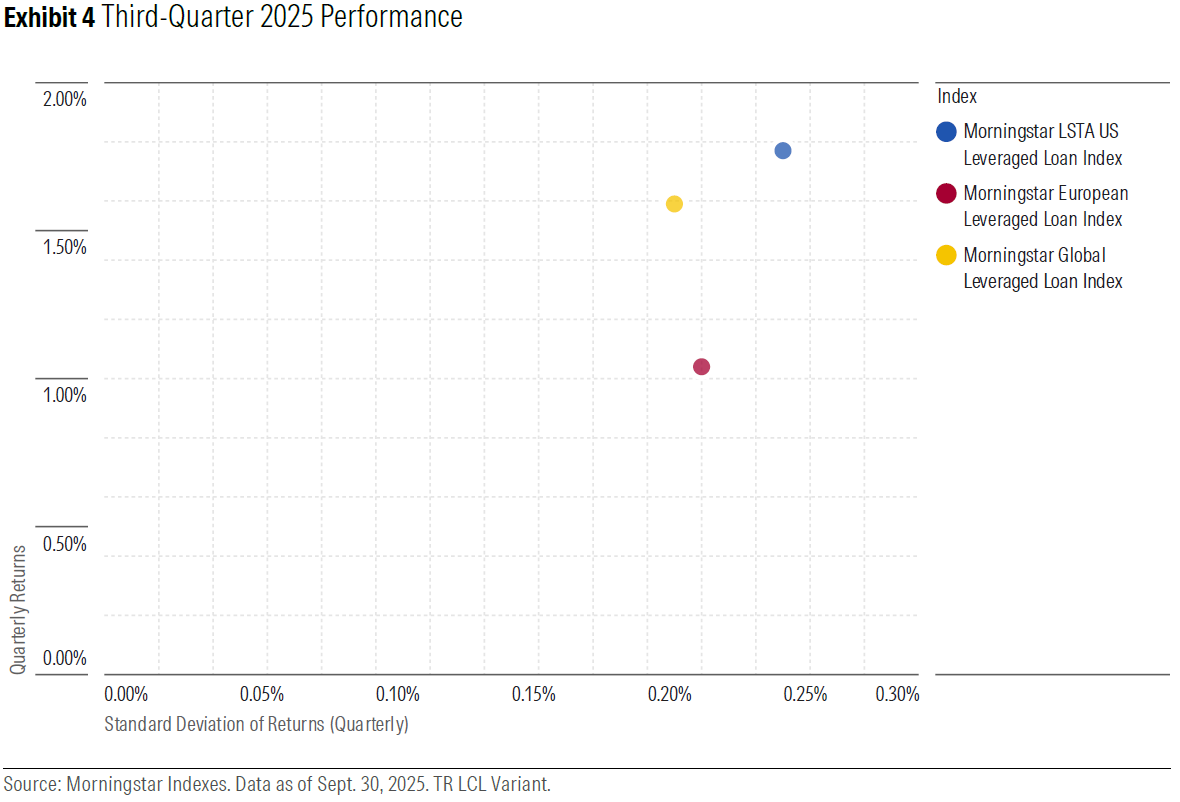

The Morningstar LSTA US Leveraged Loan Index provided the best risk/return characteristics over the third quarter of 2025 driven by increased demand in the loan market and comparatively higher base rates prevailing in the US.

The Morningstar Leveraged Loan Monitor for Q3 2025 provides a comprehensive overview of the leveraged loan market, focusing on the US, European, and global indexes. The third quarter was marked by central bank policy shifts, with the US Federal Reserve and Bank of England cutting rates to support economic growth, while the European Central Bank held rates steady. Leveraged loan yields and spreads in the US continued to tighten, while European spreads edged higher but remained near historic lows. The Morningstar LSTA US Leveraged Loan Index provided the best risk/return characteristics over the third quarter of 2025 driven by increased demand in the loan market and comparatively higher base rates prevailing in the US. Issuance activity surged in both regions, with the US and Europe seeing significant increases in new loan volumes.

©2025 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.