The Takeaway

Although classic stock/bond diversification simply has not worked in 2022 thanks to stubbornly high inflation and a string of steep interest-rate hikes, giving up on bonds seems premature.

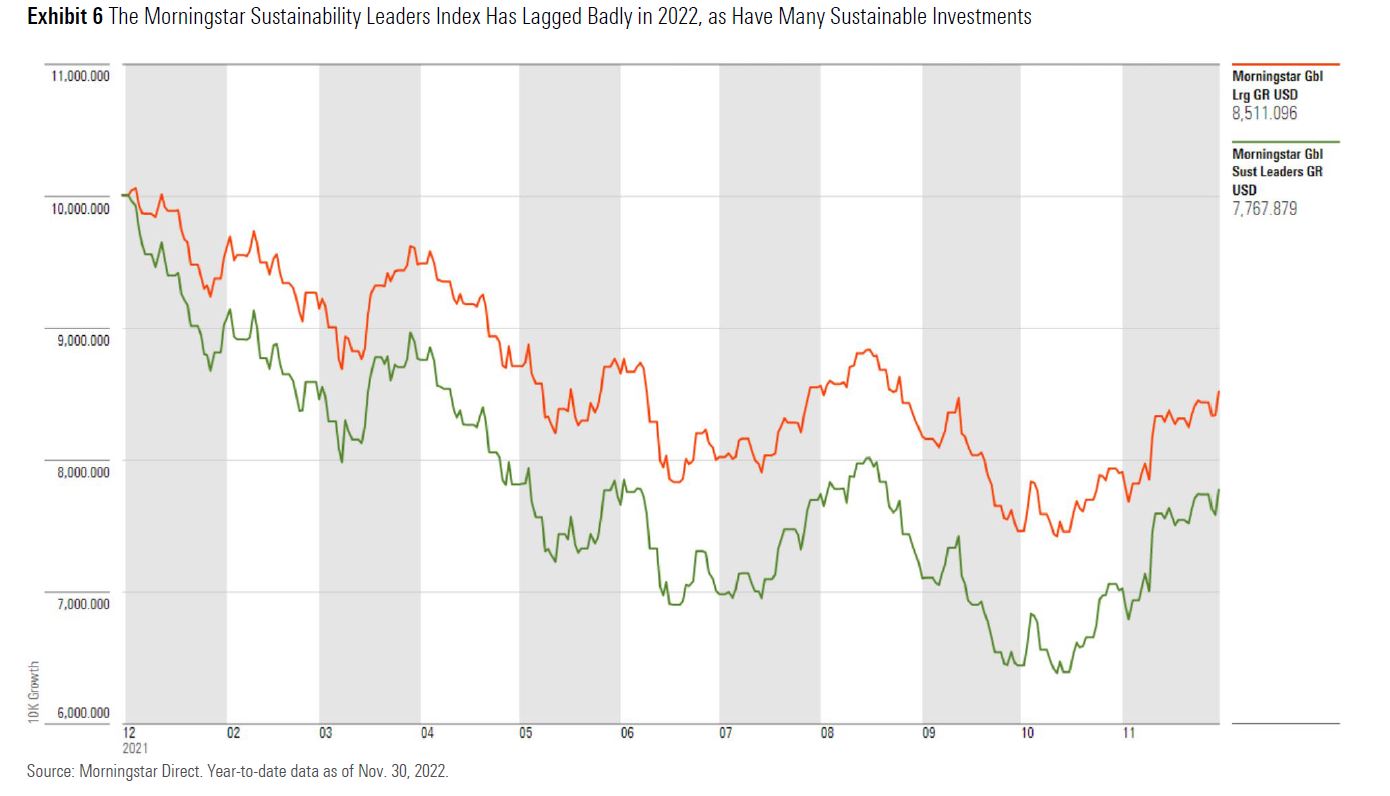

Elevated valuations coming into 2022 explain the underperformance of growth stocks, sustainable investments and thematics. Trees don’t grow to the sky.

Private asset valuations have yet to fully reflect a slowdown, but signs point to a reckoning.

There’s no shortage of received wisdom in the world of investing. Rules of thumb explain what moves markets, how assets interact, and which investments best suit the macro environment.

Much of this wisdom is flawed. The forces that drive financial market behavior are unpredictable, and relationships between assets are fluid. Investment claims are often made by those who have something to sell. What can sound axiomatic often violates actual truisms, such as "past performance is no guarantee of future results," "the plural of anecdote is not data," and "the best company can be a bad investment at the wrong price."

Markets have been vexing in 2022. Generationally high inflation, a belated but aggressive monetary policy response, and the bloodiest European conflict since World War II have wreaked havoc on stocks, bonds, and other assets. For investors, the year has delivered many painful lessons.

Ultimately, one year is a short time frame in investing. For many, the best course of action is to tune out and hang on. Investment performance in 2022 may end up as a small blip on a long upward sloping chart. More important, perhaps, are the lessons that have been learned this year—about expecting the unexpected, preparing for the worst, and accepting how little certainty there is in investing.

Here we propose five learnings from 2022:

1) Diversification isn't always a free lunch (or bonds aren't always ballast).

2) Rising interest rates don't have a predictable impact on stocks.

3) Sustainable investments aren't immune to market cycles.

4) Growth themes don't always grow.

5) Private markets don't only go up.

©2022 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.