Private equity interest and new funding rounds in biopharmaceutical and AI-related startup companies helped drive late-stage venture capital market performance in the second quarter, according to the latest edition of the Morningstar Unicorn Market Monitor.

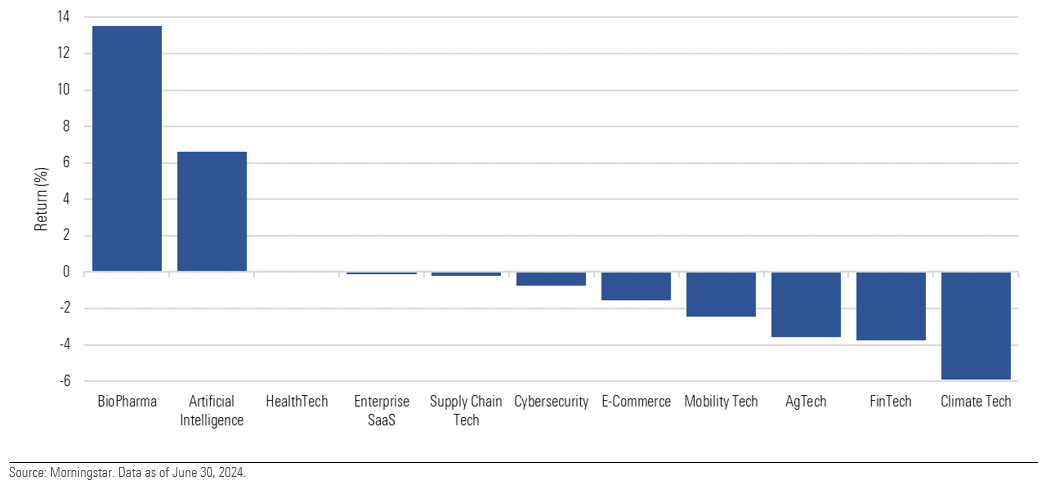

While the Morningstar PitchBook Global Unicorn 500 Index gained just 1.3% in the second quarter relative to a 2.6% rise for the Morningstar Global Markets Index, the Morningstar PitchBook Global BioPharma Unicorn Index and Morningstar PitchBook Global Artificial Intelligence Unicorn Index, which measure relative performance for late-stage VC companies within those industry verticals, rose 13.5% and 6.6%, respectively.

Q2 Growth for Morningstar PitchBook Unicorn Industry Vertical Indexes

Sanjay Arya, CFA, Head of Innovation, Morningstar Indexes:

“Investors are zeroing in on high-quality companies with solid growth and exit paths, with AI startups dominating funding. Despite modest gains in the late-stage venture market, flat and down rounds for VC-backed firms reached a decade high in early 2024, making up nearly 30% of all deals, according to PitchBook.”

Kazi Helal, Senior Emerging Technology Analyst, PitchBook:

“The BioPharma Unicorn Index led the quarter with a 13.53% gain, driven by continued venture investment growth in Q2 2024 over the previous quarter, particularly in gen AI-based drug discovery and development platforms. This development shows a revival of interest in platform companies alongside the ongoing focus on advanced clinical assets post-pandemic. Xaira's $1.0B round at a $2.7B valuation and Formation Bio raising $372.0M at a $1.7B valuation underscore AI's potential in pharma, even with the long timelines involved.”

©2024 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.