The Takeaway

Investors are increasingly focusing on high-quality companies with robust growth potential and clear paths to profitability in the late-stage venture market. This shift is driven by higher valuations and multiples for profitable exits and IPOs.

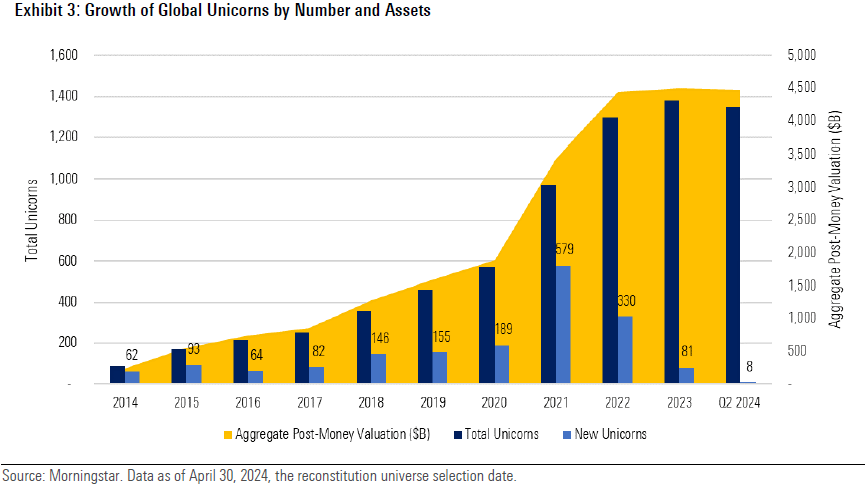

In the second quarter of 2024, eight new unicorns—private venture-backed companies valued at $1 billion or more—joined the Morningstar PitchBook Global Unicorn Index, raising the total to 1,351 companies.

Limited exit opportunities have fueled growth in the secondary market, as institutional investors seek to match their liquidity needs. Pre-IPO unicorns, especially in AI, fintech, and cybersecurity, have experienced significant increases in trading volume and transaction sizes this quarter, reflecting strong investor confidence these sectors.

In the second quarter of 2024, the late-stage venture capital market began to stabilize, showing signs of gradual recovery in company valuations, fundraising, and exits following a turbulent period. The Morningstar PitchBook Global Unicorn Index, which tracks the performance of late-stage ventures, rose by 1.15% during this period.

Despite this modest rebound, the market remains polarized. While artificial intelligence startups are attracting substantial capital and driving valuations, other startups continue to face significant challenges in raising funds due to a more selective and cautious investment environment.

©2024 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.