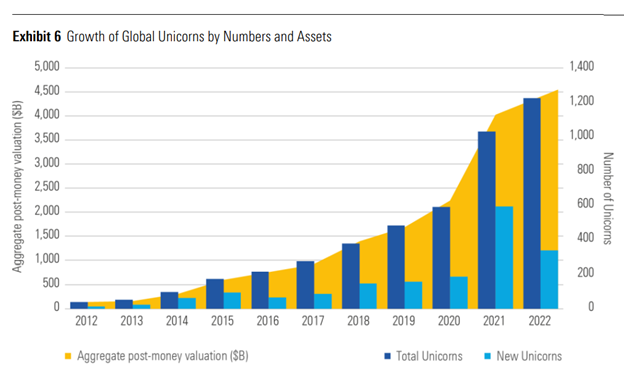

Venture capital-backed companies valued at $1 billion or more, commonly referred to as Unicorns, continued to proliferate in 2022 despite a challenging global market environment, while IPOs for Unicorns have become more rare, according to the first Morningstar Unicorn Market Monitor, created by Morningstar Indexes.

In 2022, venture capital-backed companies raised $508.7 billion as compared to $180 billion raised through public market offerings. Yet Unicorns were not immune from the market turbulence last year, as unicorn funding rounds dropped 67% from the first quarter to the fourth quarter and just 27 global unicorns went public through initial public offerings in 2022.

Notably, of the 27 global unicorn companies that went IPO in 2022, 26 came from the Asia-Pacific region. And notable departures from the Morningstar PitchBook Global Unicorn Indexes in 2022 included FTX, Celsius and BlockFi, all cryptocurrency firms that filed for bankruptcy.

Sanjay Arya – Head of Index Innovation, Morningstar:

“Despite the market turmoil in 2022, the structural shift in capital markets from public to private markets continued. Unicorn fundraising in 2022 was down from its record heights in 2021 but still logged its second-highest year.”

Kyle Stanford, CAIA, Senior Venture Capital Analyst, PitchBook:

“We saw many unicorns exercise fiscal caution in the latter half of the year as investors shifted their focus from ‘growth at all costs’ to profitability. Not only did we see companies bypass fundraising in order to not risk a hit to their valuations, but capital has fled the late-stage venture market, lowering the opportunity for many companies to raise new financing and creating a gap between the capital needs of unicorns and amount available in the market.”

©2022 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.Back-tested strategies are created with the benefit of hindsight. As such, the strategies do not represent actual index changes and may not reflect the impact material economic and market factors had on the decision-making process for an index. Back-tested performance is hypothetical in nature, does not reflect actual results, and does not guarantee future results. Hypothetical performance returns are theoretical and for illustrative purposes only. Future performance can differ significantly from the back-tested performance shown.

Morningstar indexes are created and maintained by Morningstar, Inc.Morningstar® is a registered trademark of Morningstar, Inc. PitchBook was acquired by Morningstar in 2016 and now operates as an independent subsidiary.