The Brazilian equity market was decidedly in the black in 2022, a year which saw the majority of global equity markets end in the red, according to Morningstar Indexes.

The Morningstar Brazil Index, measuring the performance of the top 97% of Brazilian stocks by market capitalization, rose 10.8% in 2022. This compares to a 17.9% decline for the Morningstar Developed Markets Index and an 18.8% decline for the Morningstar BRIC (Brazil, Russia, India & China) Target Market Exposure Index for the same time period.

Yet Brazil’s strong market performance in 2022 was built on a relatively narrow foundation. The Morningstar Brazil Index had a nearly 24% weighting in Basic Materials at the end of January, with a 17.5% position in sustainable mining company Vale SA, and a 15% weighting in Energy. By comparison, the Morningstar Global Developed Markets Index had just a 4.8% allocation to Basic Materials and 5.3% in Energy at the end of January.

Alex Bryan, Director of US Equity Product Management, Morningstar Indexes:

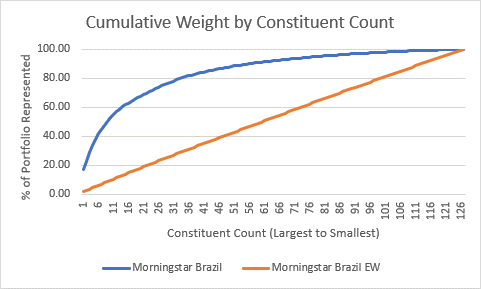

“Diversification is always a good idea. However, in the case of Brazilian equities it’s difficult to achieve a strong level of diversification by relying solely on a traditional market-cap weighted index portfolio. As illustrated in the chart below, equal weighting can offer a transparent way to improve diversification, as it limits the impact of firm-specific risk and gives all eligible stocks an equal chance to contribute to performance.”

Clayton Rodrigues, Head of Quantitative Strategies, Bradesco Asset Management:

“The Brazilian investor market is becoming more sophisticated. Over the past couple of years, we’ve seen increased investor interest in different types of asset allocation instruments and strategies, including ETFs. Our clients have been asking for new ways to gain exposure to Brazilian equities in more specific, tactical and diversified ways.”

Morningstar Indexes recently joined forces with Bradesco ETFs, introducing four new indexes offering different views on Brazilian equities to help investors avoid concentration risk. The Morningstar Brazil Defensive Sectors Equal Weighted Index, Brazil Cyclical Sectors Equal Weighted Select Index, Brazil Equal Weighted Index and Brazil Target Momentum Index serve as the basis for four new ETFs.

Note: Bradesco's products are not sponsored, endorsed, sold or promoted by Morningstar, and Morningstar makes no representation regarding the advisability of investing in Bradesco's products.

©2023 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.