Morningstar Indexes emphasizing companies committed to gender equity and inclusion outperformed their broad market counterparts in the last year, representing a rare bright spot among indexes focused on environmental, social and governance (ESG) criteria.

The Morningstar Developed Markets Gender Diversity Index, which focuses on developed market companies that have strong gender diversity policies and practices, declined 16% in 2022 relative to a 17.8% decline for its parent index the Morningstar Developed Markets Large-Mid Cap Index. And as of February 27, the Index is up 4.5%, keeping pace with the 4.8% return for the parent.

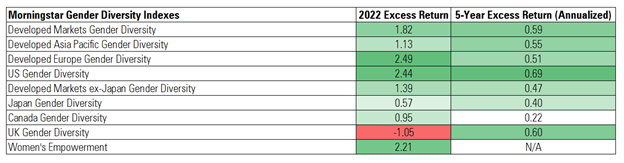

In fact, in 2022 all but one of Morningstar’s gender-focused indexes outperformed their broad equity market equivalent.

Source: Morningstar Direct. Data as of Dec. 31, 2022.

What’s behind this outperformance? Morningstar Indexes experts cite below-market exposure to the technology sector, which tends not to score well on gender criteria, and above market exposure to energy and defensive sectors like healthcare and consumer defensive as major contributors over the past year.

Amelia Furr, Global Head of Sales, Morningstar Indexes:

“Our ESG indexes are as diverse as the ESG landscape itself, and performance across our ESG suite will vary based on broad market cycles. In the case of our gender diversity indexes, in addition to offering investors the ability to gain exposure to companies that demonstrate strong diversity practices, index performance has been quite strong.”

Diana Van Maasdijk, Co-Founder and Executive Director, Equileap:

“Equileap's data and gender equality rating methodology helps develop transparent and rigorous market benchmarks that measure and accelerate progress toward gender equality in the workplace. Our Gender Equality Scorecard, which is embedded in the methodology for Morningstar gender diversity indexes, spans 19 criteria including gender balance, gender pay gap, paid parental leave and anti-sexual harassment policies.”

©2023 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.