The popularity of thematic investing has grown by leaps and bounds in recent years. So have the risks.

It is one thing to identify a macro theme for investment, but quite another to assemble a portfolio of companies that closely follows this theme. Oftentimes, thematic strategies represent long-term trends that don’t align with traditional industry classifications, and companies often do not report their financial results in a manner that clearly aligns with a targeted theme. The result can be a watered-down representation of the portfolio result the investor is trying to achieve.

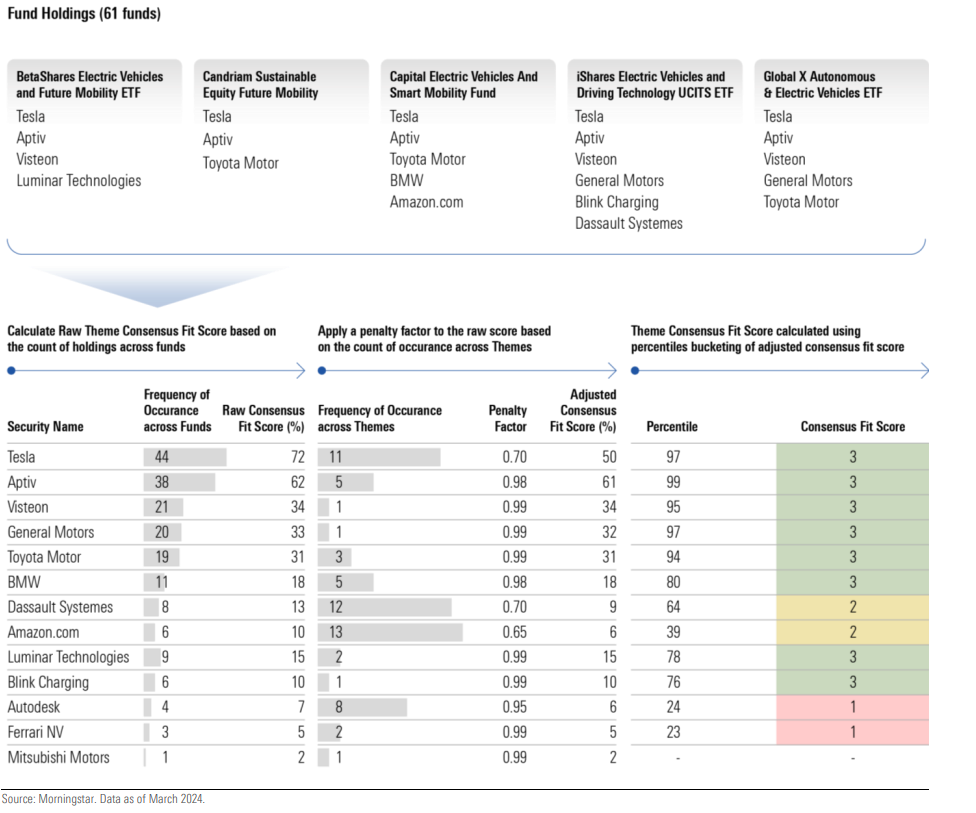

Morningstar has developed a market consensus-based approach to identify stocks most clearly associated with each theme. In new analysis, Morningstar Indexes outlines a new methodology using insights from Morningstar Manager Research and Morningstar Quantitative Research to identify companies where there is broad investor consensus of relevance to a particular theme. The resulting Theme Consensus Fit Score methodology is a key part of the new Morningstar Thematic Consensus Indexes. Companies must receive a ranking of “3,” the highest consensus for a score, to be eligible for the indexes. This score indicates that a company is widely held across funds that target the same theme and helps ensure that companies associated with multiple themes are de-emphasized.

Theme Consensus Fit Score Example – Future Mobility Theme

Alex Bryan – Director of Equity Product Management, Morningstar Indexes:

“Index investing is based on the belief that the market’s collective wisdom is hard to consistently beat. Applying a market-driven approach to thematic investing across our 15 new Morningstar Thematic Consensus Indexes has enabled us to provide a more representative solution for defining thematic exposure.”

Kenneth Lamont, Senior Analyst, Morningstar Manager Research:

“When investing thematically, focus can often be a critical factor in determining long-term success. The value of identifying a compelling long-term macro theme can quickly diminish if the companies underneath this theme are not fully aligned. Drawing on the ‘wisdom of the crowd,’ — i.e., validating that your companies are widely held by investment funds targeting the same theme — can be a good approach.”

©2024 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.