After a 2021 for the global markets which felt like an episode of “Who Wants to be a Millionaire,” 2022 has felt more like “Fear Factor,” according to new analysis.

Indeed, 2022 has presented a worst case scenario for global investors, with equally disappointing returns across both stocks and bonds amid stubbornly high inflation, global interest rate hikes, recessionary fears, war in Europe and a rising US dollar.

Yet challenging markets often present opportunities for patient investors, according to Strategist Dan Lefkovitz, and bright spots may exist for those who look a little harder. He points out some of these potential opportunities in his recent market analysis:

1.Stay Invested. In times of extreme market volatility, fear can take over and investors may want to run for the exits. Yet research on money-weighted returns, which adjust for asset flows, show that investors tend to mistime their purchases and sales, buying high and selling low, failing to reach their full return potential.

2.Take a Fresh Look at Your Asset Allocation. In times of market turmoil, the former “cool kids” of asset allocation may not look so cool anymore and curious investors may be rewarded by examining less obvious areas of the market. For example, the Morningstar MLP Composite Index, which identifies master limited partnerships involved in the transportation, storage and processing of oil, natural gas and other energy sources, rose 22% in the first three quarters of 2022. Leveraged loans are another bright – or at least less dim – spot this year, with the Morningstar LSTA US Leveraged Loan Index down just 3.2% through September 30 as compared to a 14.6% decline for the Morningstar US Core Bond Index. Investors are enjoying unprecedented yields today as well, with the Morningstar US Core Bond Index yielding 4.7% as of September 30, up from 1.7% at the beginning of the year.

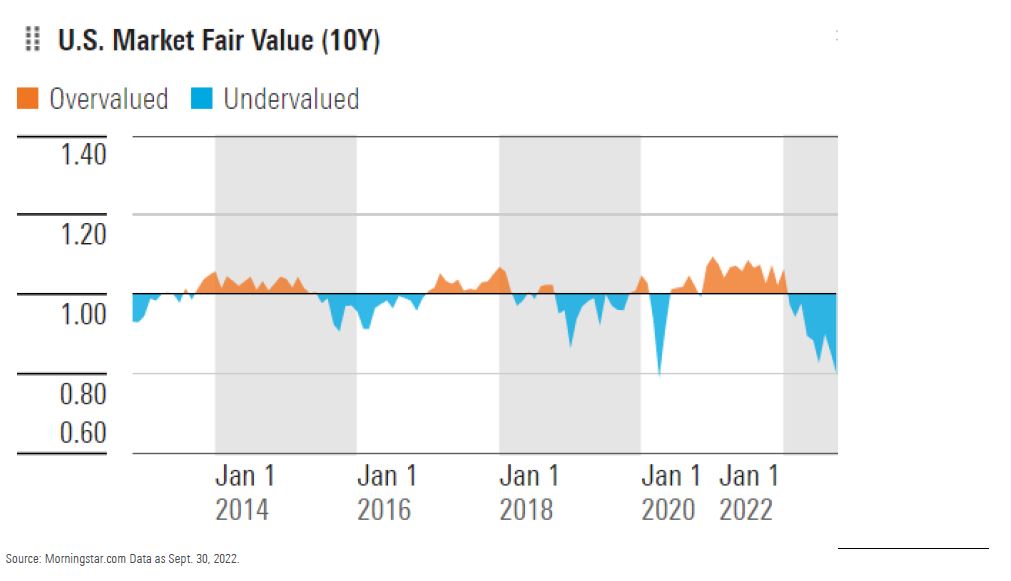

3.Go Shopping. According to Morningstar Equity Research, when assigning fair value estimates to more than 1,500 stocks in the US and globally using long-term discounted cash flow modelling, the market was roughly 20% undervalued at the end of the third quarter. The last time we saw such a discount was in the first quarter of 2020 during the global pandemic sell-off.

Dan Lefkovitz, Index Strategist, Morningstar

“The fourth quarter of 2022 could see further declines in asset prices. Losses could even continue into 2023. But eventually, equity prices and fair values should converge, and higher current bond yields are positive for both income and future total returns. Investors would do well to remember that all previous downturns have given way to periods of capital appreciation that more than compensated for short-term losses. In hindsight, we may look back at the losses of 2022 as a pothole in a long, upward-sloping road.”

To speak with Dan Lefkovitz, reach out to Tim Benedict at tim.benedict@morningstar.com or (203) 339-1912.

©2022 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing. High Yield Investments commonly known as “junk bonds” or “high-yield securities,” may be subject to increased interest, credit, and liquidity risks.

All investments involve risk, including the loss of principal. There can be no assurance that any financial strategy will be successful. Customers should seriously consider if an investment is suitable for them by referencing their own financial position, investment objectives, and risk profile before making any investment decision.

Past performance is no guarantee of future results.

Fixed-income securities are influenced by interest rate sensitivity and credit risk. They have varying levels of sensitivity to changes in interest rates, but in general, the price of a fixed-income security tends to fall when interest rates rise and vice versa. The value of a fixed-income security with a longer duration or maturity is typically impacted more by a change in interest rates than one with a shorter duration or maturity.

Credit risk is the risk an issuer cannot make interest and principal payments when due. If an issuer or guarantor of a security defaults or is downgraded, or if the value of the assets underlying a security declines, the value of the investment will decline and may become worthless.

Investors should be aware of an issuer’s assets, debt, and solvency prior to investing. Other risks to investing in fixed-income securities include early redemption risk, extension risk, income risk, inflation risk, liquidity risk, and prepayment risk.

Investment research is produced and issued by subsidiaries of Morningstar, Inc. including, but not limited to, Morningstar Research Services LLC, registered with and governed by the U.S. Securities and Exchange Commission.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc. Indexes are not available for direct investment.