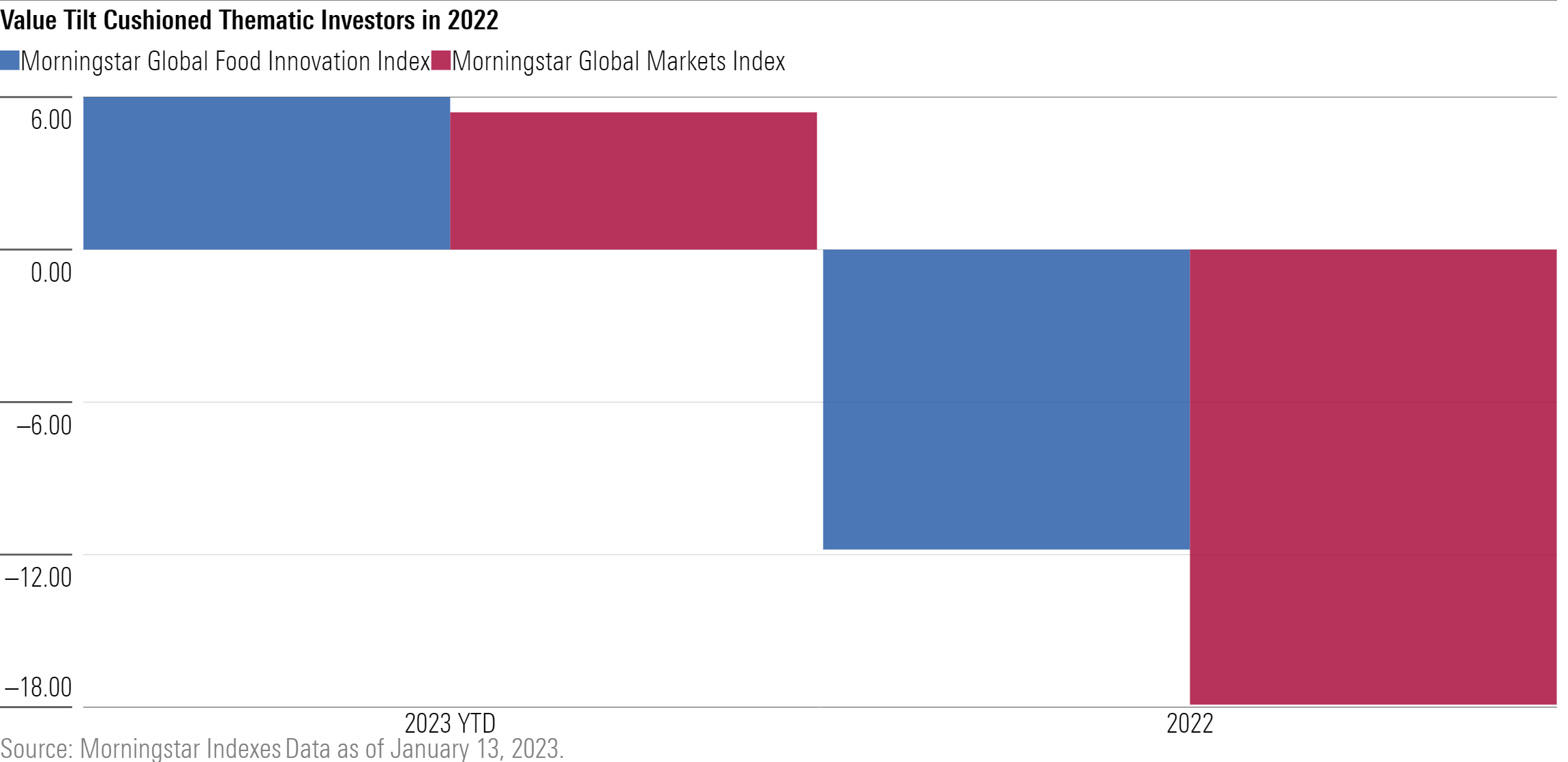

With thematic investment strategies typically leaning towards “growth” rather than “value,” many suffered disappointing results in 2022. However, the Morningstar Global Food Innovation Index has a value tilt, which helped it hold up much better than the broader market last year. Indeed, the index declined 11.8% versus 17.9% for the Morningstar Global Markets Index.

The Index, which provides concentrated thematic exposure to companies with material revenue and rising profits from their exposure to innovative areas like AgTech, alternative proteins, food safety, and sustainable food production, is off to a favorable start in 2023 as well.

The Morningstar Equity Research team believes that the efficiency of the global food system will have a material impact on future climate change. Continued growth of the global food system’s carbon footprint can be restricted by innovations that improve efficiency and reduce waste. The Morningstar Global Food Innovation Index provides exposure to companies helping to drive these innovations.

Andrew Lane, Director of Equity Research, Index Strategies, Morningstar Research Services:

“The Morningstar Global Food Innovation Index is unique in that it skews heavily toward value rather than growth while still providing exposure to innovative firms positioned to benefit from advances in food. This value tilt is reflected in the performance of the index in 2022 relative to the broad market.”

Lane points to the makeup of the Index, which is currently weighted heavily toward stocks in more traditional defensive and value-oriented sectors like industrials (Kubota Corp.), consumer defensive (Ingredion Inc.) and basic materials (Nutrien Ltd.).

Rebecca Scheuneman, Senior Equity Analyst, Morningstar Research Services:

“With a fixed amount of arable resources in the world, a growing global population and emerging demand for more protein-based diets, we are seeing heightened innovation in food production. We believe some of the best opportunities for investors in this area reside within some of the larger, more value-oriented companies that are embracing this trend. The Morningstar Global Food Innovation Index reflects this approach.”

To view a video interview with Andrew and Rebecca, go to the Morningstar Indexes website.

©2023 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.