Syndicated bank loans, once considered a niche asset class, have grown in popularity and scope, according to new insights from Morningstar Indexes based on the Morningstar LSTA US Leveraged Loan Index.

In fact, according to Dan Lefkovitz in his recent Morningstar.com article on fixed-income market flows and investor preferences, Morningstar’s bank loan category for funds is one of the fastest growing in Morningstar’s database, and the US syndicated bank loan market is now larger in value than the market for high-yield bonds.

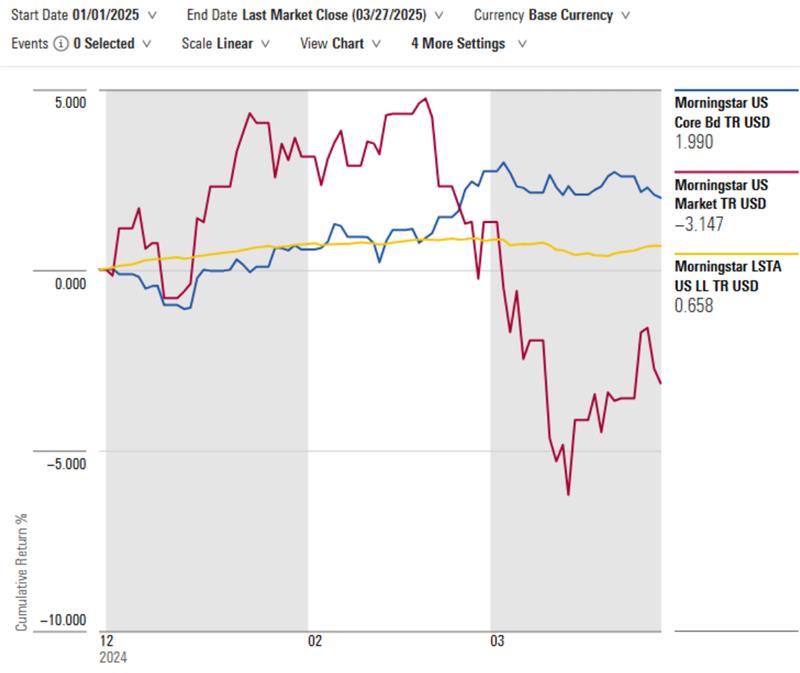

Lefkovitz goes on to cite some reasons investors may be attracted to syndicated bank loans. Unlike high-yield bonds, bank loans have floating-rate coupons, so their yields rise along with interest rates. The Morningstar LSTA US Leveraged Loan Index yielded nearly 9% as of March 7, 2025. And while bank loans’ credit risk profile does increase their correlation with equities, they have held their own, as have other fixed-income asset classes, amid the US equity market selloff of 2025’s first quarter.

US Leveraged Loans in 2025: Morningstar Indexes

The long-term growth story of bank loans is also linked to the convergence of public and private markets, as explained by Elizabeth Templeton of Morningstar Indexes.

Elizabeth Templeton – Manager, Fixed Income & Multi-Asset Indexes

“Credit investors are increasingly viewing leveraged loans as an attractive asset class. The Morningstar LSTA US Leveraged Loan Index is often used as a proxy for private credit. Not only are many loan issuers backed by private equity investors, but collateralized loan obligations are big buyers of loans.”

©2025 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.