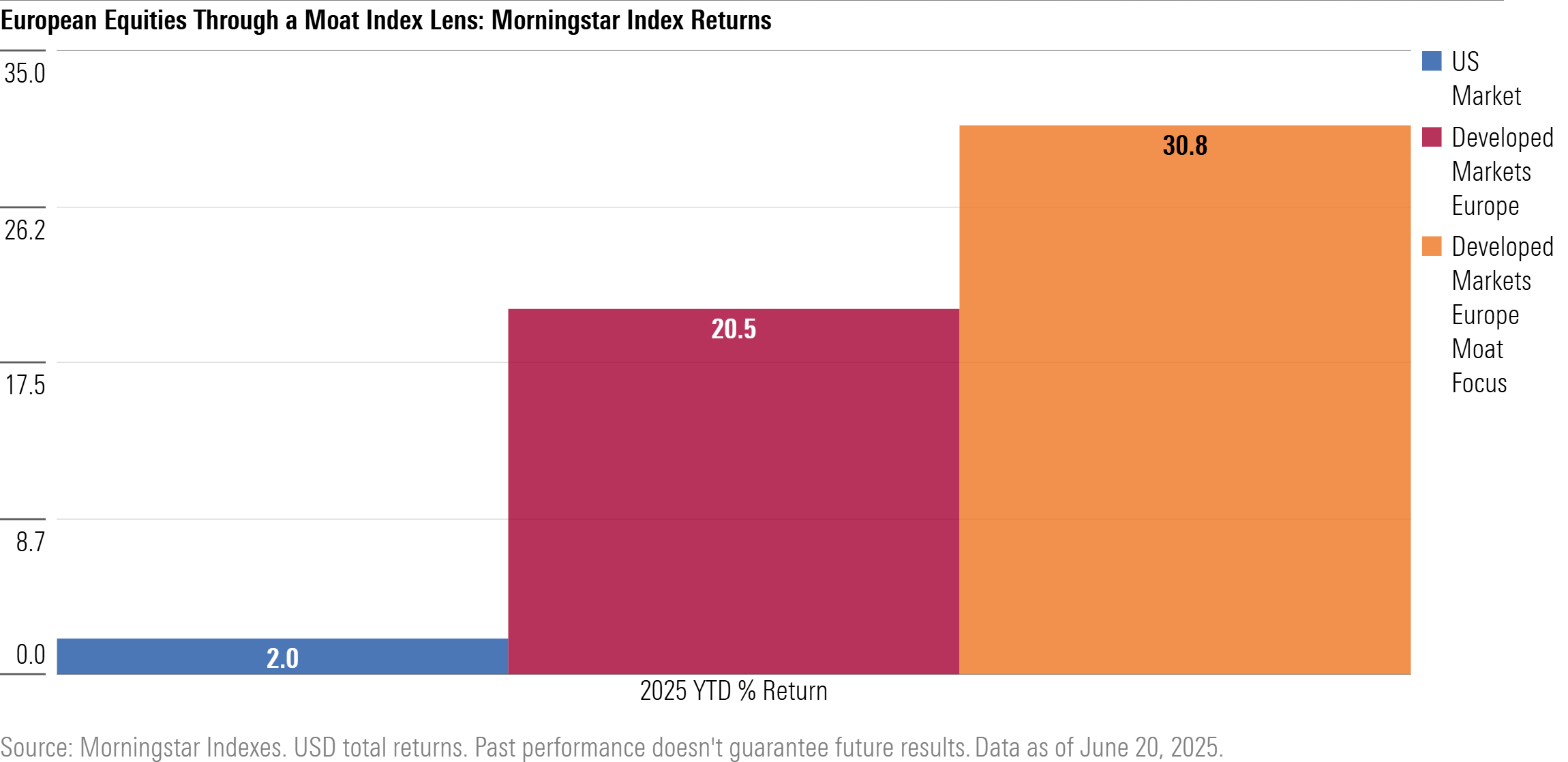

As we approach the close of a first half of a year that has seen the Morningstar Developed Markets Europe Index outperform the Morningstar US Market Index by more than 18 percentage points, adding an additional research lens based on the qualitative insights of the Morningstar Equity Research team has contributed an additional 10 percentage points, according to Morningstar Indexes.

The Morningstar Developed Markets Europe Moat Focus Index, which is designed to provide exposure to companies in the Morningstar Developed Markets Europe Index with Morningstar Economic MoatTM Ratings of wide or narrow trading at the lower current market price to fair value ratios as determined by Morningstar Equity Research, has risen 30.8% year to date as of June 20.

Among top contributors to index performance this year are current index top weighting E.ON SE (EOAN), the Germany-based multinational utility, British multinational telecommunications BT Group PLC (BTGOF), and Dutch multinational online food ordering and delivery company Just Eat Takeaway.com NV (TKAYF).

Michael Field, CFA – Chief European Equity Market Strategist, Morningstar:

“We’ve seen a sustained rotation away from US assets since late 2024, with outflows from the US and into Europe accelerating in the second quarter in the wake of Trump’s announced global tariffs. As prospects for the European economy have improved and uncertainty around the direction of US trade policy has increased, it makes sense that investors are increasing their exposure to Europe as reflected in European equity market performance.”

Maggie Stafford – Associate Director of Product Management, Morningstar Indexes:

“We are seeing increased interest from European investors in research-driven, rules-based index strategies, which can provide customized exposure to broad equity markets. Our Developed Markets Europe Moat Focus Index is a great example of the potential benefits of adding a research and valuation screen, which incorporates the unique fundamental insights of Morningstar Equity Research within a broad market index.”

©2025 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.