The Takeaway

Dividend-paying stocks represent a source of income, but also have a strong performance history relative to global equity markets.

Durability of shareholder payouts is critical to assess, in addition to another dimension of sustainability—environmental, social, and governance-related risk.

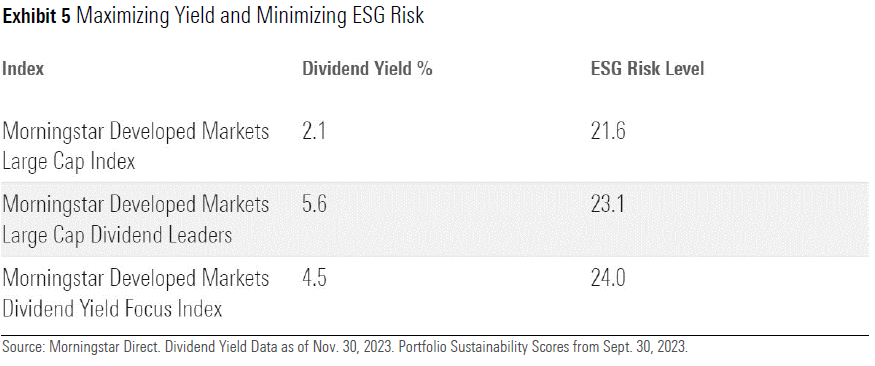

Morningstar Developed Markets Large Cap Dividend Leaders Screened Select Index balances equity income and ESG considerations, aiming to maximize yield while minimizing material ESG-related risks.

The shares of dividend-paying companies represent a means of achieving both regular income and capital appreciation. While many investors value dividends for their cash payouts, the high-yield section of the equity market has quietly outperformed over the long term. Companies with the wherewithal to distribute some of their earnings to shareholders are generally more stable, their management teams more disciplined, and their shareholder bases more loyal than non-payers.

Yet, equity income investing is far from risk-free. Attractive-looking yields can ultimately prove illusory. Dividend payments may be reduced, suspended, or eliminated at any point, and dividend cuts are often accompanied by share price depreciation. Screening for the sustainability of the shareholder payout is imperative, from the perspectives of income and total return.

Another aspect of sustainability has come to the forefront in recent years. Investors increasingly view environmental, social, and governance (ESG)-related issues as financially material. Many dividend-paying companies are in economic sectors, such as energy, utilities, and industrials, that face risks related to carbon emissions and health and safety. Others offer products with objectionable societal impact, such as tobacco or weapons. Balancing equity income and ESG can be challenging.

These dual dimensions of sustainability -- dividend durability and ESG—can both be effectively captured in a rules-based passive index methodology of an index. The Morningstar Developed Markets Large Cap Dividend Leaders Screened Select Index represents a selective approach to equity income. The index includes the shares of 100 consistent dividend payers from various geographies, with the capacity to sustain payouts. It also seeks to mitigate ESG risk.

©2023 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.