Asset owners globally consider private assets a close second to listed equities in terms of environmental, social and governance (ESG) materiality, according to the third annual Morningstar Voice of the Asset Owner Survey.

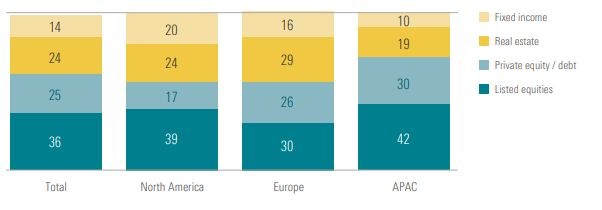

When asset owners are asked the question – ESG information is the most relevant for which asset class? – 25% of the 500 asset owners surveyed cited private equity and debt, as compared to 36% for listed equities, 24% for real estate and 14% for fixed income.

Paul Schutzman - Head of Institutional Solutions, Morningstar:

“Asset owners have steadily increased their allocations to private markets, often allocating a third or more of their portfolio to private equity and private debt. With private companies making up such an important segment of institutional portfolios, it is no surprise that investors are looking to use all available information to better understand and validate the significance of ESG-related risks and opportunities.”

A recent market survey by PitchBook, part of Morningstar, builds on this point, noting in its 2024 Sustainable Investment Survey that there are several segments within private markets with highly material ESG issues, notably Energy, Water, Climate Tech, Healthcare and Education. In PitchBook’s survey of 527 investors representing venture capital, fund managers, general partners, asset owners, fund-of-funds, private wealth advisory or family offices and investment consultants, more than six in 10 (64%) of respondents stated that they incorporate environmental, social, or governance factors into the process of evaluating and managing their investments.

©2024 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.