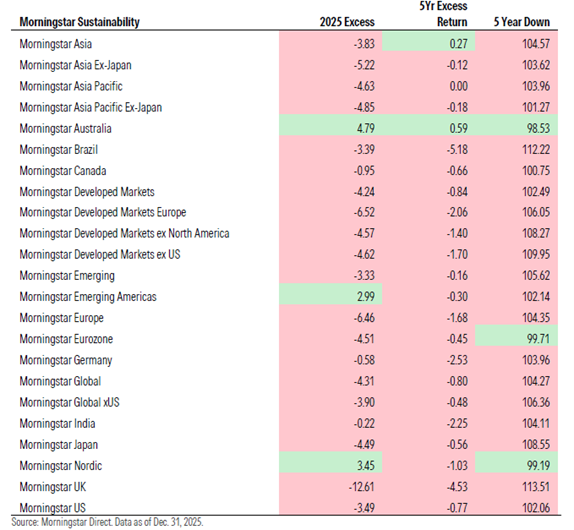

Indexes focused on sustainability factors generally underperformed in a year when global indexes were dominated by mega-caps tied to the artificial intelligence theme, according to a new report from Morningstar Indexes.

In the new report - In an AI-Led Stock Market, Sustainable Investments Struggle to Keep Up - Morningstar Indexes EMEA Managing Director Rob Edwards describes the challenge faced by indexes that incorporate environmental, social, and governance (ESG) criteria in 2025 amid heightened concentration risk for global equity markets. Notably, in 2025, 26% (38/145) of Morningstar’s sustainability indexes outperformed their non-ESG equivalents, a significant drop from 45% in 2024 and 44% in 2023.

Edwards goes on to suggest five factors—some detracting, some contributing—driving sustainable index performance last year. Notably, these include mega-cap concentration and related AI risk, the exclusion of Alphabet from many sustainability indexes, the bounce back for renewable energy stocks, the success of carbon-intensive stocks, the lack of defense stocks, and below-market exposure to financial services in sustainability indexes outside the US.

Rob Edwards – Managing Director, EMEA, Morningstar Indexes:

“In 2025, we were reminded that, to understand the performance of any portfolio, you must fully recognize active risks you are taking versus the broad market. What is certain is that any deviation from a market portfolio will produce a different outcome. Some market environments will favor sustainable investment strategies and others won't. Studying past behavior can help expectations for sustainability-focused investors going forward.”

©2026 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.