The Takeaway

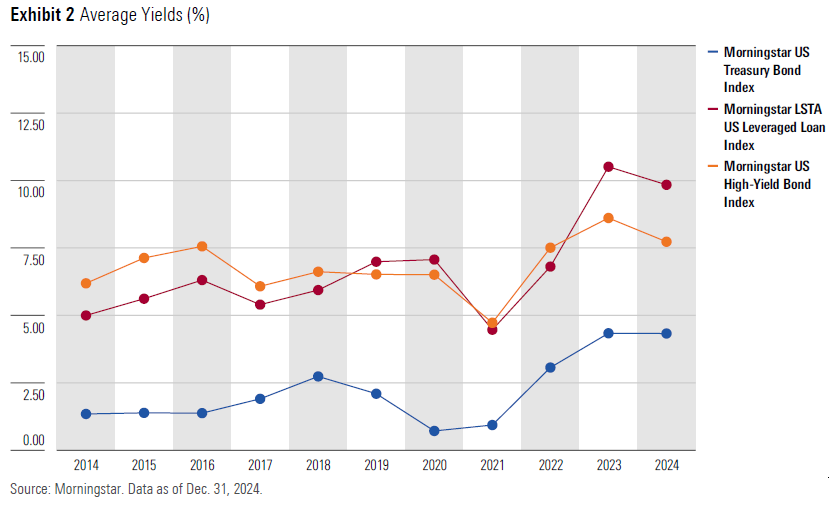

While leveraged loans and high-yield bonds both provide exposure to non-investment-grade instruments, a key distinction between the two asset classes is in their coupon payment structure: Leveraged loans are primarily floating in nature; high-yield bonds typically have fixed coupons.

Leveraged loans outperformed high-yield bonds during rate-hike cycles. The much lower duration of leveraged loans owing to their floating-coupon payment structure protected the asset class from adverse impact because of rate hikes.

High-yield bonds outperformed leveraged loans during rate-cut cycles due to their greater sensitivity to interest-rate movements, allowing them to benefit more significantly from declining interest rates.

Leveraged loans and high-yield bonds offer attractive yields compared to Treasuries and investment-grade bonds, reflecting their higher credit risk. These asset classes serve as valuable tools for portfolio diversification, enhancing risk-adjusted returns. Historical performance analysis highlights that leveraged loans exhibit lower correlation to equities than high-yield bonds, making them a superior diversifier. Using Markowitz efficient portfolio theory, studies across multiple time frames show that leveraged loans contribute to more resilient portfolios with improved risk-adjusted returns. Additionally, their floating-rate structure reduces sensitivity to interest rate fluctuations. During rate-hike cycles, leveraged loans have historically outperformed high-yield bonds, while high-yield bonds tend to deliver stronger returns in rate-cut environments. By strategically incorporating both asset classes, investors can optimize portfolio performance across different market conditions.

©2025 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.