The Takeaway

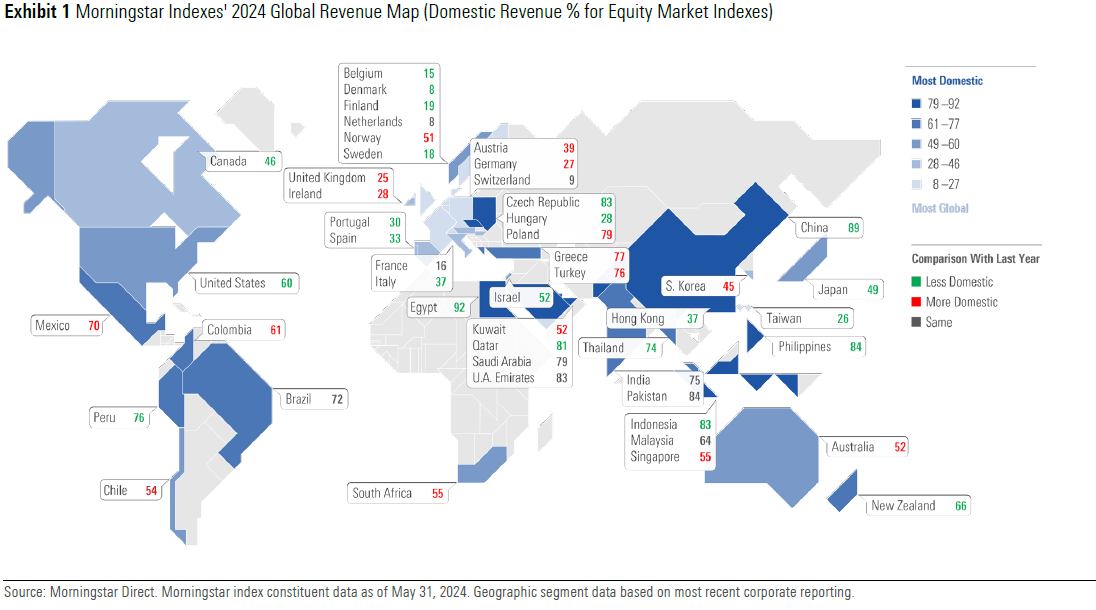

When estimates of geographic sources of corporate revenue are aggregated to Morningstar Global Markets Indexes, it’s apparent that many national equity markets are not very national. The Morningstar US Market Index, for example, derives just 60% of revenues from the US. Western European markets are the world’s most global. Emerging markets, especially in Asia and Eastern Europe, are the most domestic in their revenue sources. Sector-level dynamics explain some of these trends.

Revenue sources help explain why correlations between developed markets have risen, while emerging markets tend to be less correlated with developed markets.

Contrary to the narrative that globalization is in decline, just 16 of 48 markets became more domestic in their revenue sources compared with last year. The US, Japan, and China all became more global.

Geopolitical risk is high on investors' minds. With wars raging, trade tensions rising, and elections challenging established orders, many are trying to gauge the investment impact of current events on markets. Revenue sources are critical to examine.

This annual study examines geographic revenue sources for Morningstar Global Markets Indexes by aggregating company-level data. The 48 single-country indexes are carve-outs from the Morningstar Global Markets Index, which represents roughly 97% of equity market capitalization across developed and emerging markets and includes large-, mid-, and small-cap equities. The index included 8,029 constituents as of May 31, 2024.

Morningstar Global Geographic Segment Data, which can be found in the Morningstar Direct research platform, enables an investment's revenues to be broken down by regional source. It leverages annual and semiannual filings for publicly listed companies across the globe. Company-level revenue data is then aggregated to understand portfolio-level exposure, for mutual funds or indexes.

©2024 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.