The Takeaway

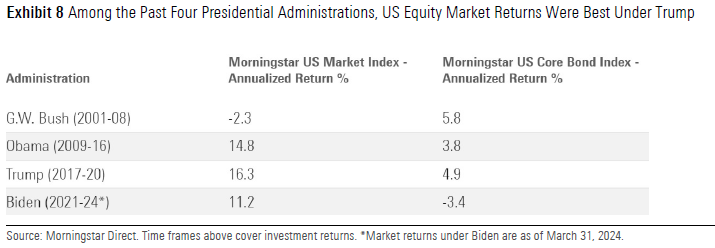

When comparing US equity and bond market performance under the past four presidential administrations, we see that stocks did best under Trump and performed the worst under Bush. Equity returns under Obama were also very strong, and stocks have posted solid gains under Biden. Bonds did best under George W. Bush. The broader context is critical to examine, of course.

Small-cap value stocks rallied after both Trump's election in 2016 and Biden's in 2020, before large growth reclaimed its dominant position over the US equity market. Counterintuitively, technology ended up as the best-performing equity sector under Trump, and energy stocks have done best under Biden.

Though the (presumed) candidates in 2024 are familiar, market behavior in 2024 will likely differ from 2016 or 2020. Circumstances have changed, and markets learn from the past.

It's often said that politics and investing don't mix, but that's not because political dynamics have no impact on financial markets. Taxing and spending, policy and regulation—these are all important variables that can affect stocks, bonds, currencies, and commodities.

But politics are just one of the many forces that move asset prices. Markets have thrived (and sometimes crashed) under administrations of all stripes. Plus, the emotions intertwined with political beliefs present behavioral challenges, undermining the type of rational, coolheaded decision-making that investing demands. Then there's the fact that political forecasting is tricky business. Predicting the reaction to elections ratchets up the degree of difficulty.

Those caveats won't stop us from contemplating the investment implications of US presidential elections in November 2024, principally by examining the behavior of various Morningstar benchmarks in the previous election years of 2016 and 2020. After all, this year's race offers the unique scenario of two candidates who have won before—unless the winner is somehow not named Trump or Biden.

©2024 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.