Artificial intelligence is the investment theme of 2023. From mega-caps like Microsoft and Nvidia to smaller names like UiPath and Marvell Technology, most of the stock market’s winners this year are perceived beneficiaries of generative AI. Since the launch of ChatGPT in late 2022, hype (and apocalyptic hand-wringing) has steadily built around this potentially transformative technology.

There’s considerably less enthusiasm for investments related to natural resources. Yet businesses that mine, drill, and harvest—not data but physical goods—are as essential as ever. The Morningstar Global Upstream Natural Resources Index, which tracks the performance of equities linked to energy, metals, agriculture, timber, and water, has declined in value in 2023, even as the broad market is up.

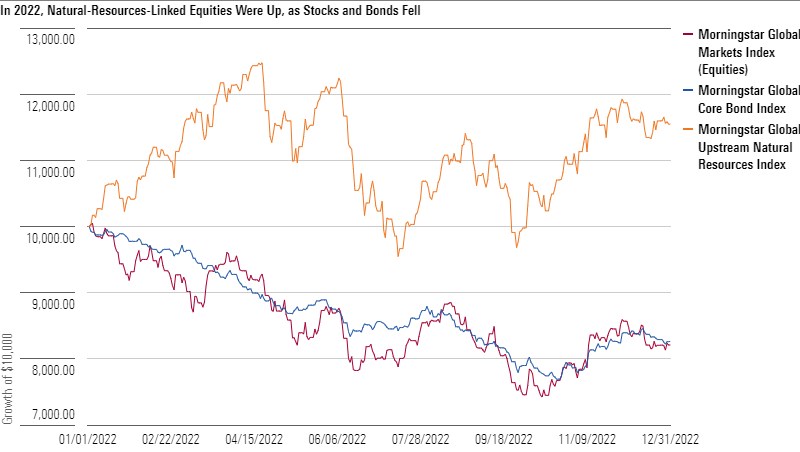

That’s a sharp reversal from 2022. As inflation went from “transitory” to “stubborn” and both stocks and bonds plunged, companies benefiting from rising commodities prices stood out as bright spots. The Global Upstream Natural Resources Index actually rose in 2022. This ability to zig while other asset classes are zagging gives natural-resources investments investment utility—especially in a market epoch dominated by technology.

Why Equities? Why Upstream?

Commodities futures are a popular means of gaining investment exposure to oil, natural gas, metals, and agriculture products, which have historically offered a measure of protection against inflation. While they have their strengths, futures contracts also carry risk. Futures-based strategies require continually replacing expiring contracts with new ones at potentially higher costs.

The shares of companies linked to natural resources allow investors to avoid the complex and volatile nature of futures. Liquidity, tax efficiency, capital appreciation and dividend income are other potential advantages. The equity market also offers exposure to commodities that can’t be accessed through futures, such as timberland and water.

The “upstream” portion of the supply chain is thought to be most sensitive to commodity price movements. This is where companies extract resources like timber, metal ores, and fossil fuels. Their revenues, earnings, cash flows, and, therefore, valuations tend to be more correlated to spot prices. Downstream companies, on the other hand, are often “takers” of natural-resources prices and face challenges associated with processing, refining, packaging, and distribution.

Natural-Resources Investments Can Behave Distinctively

The correlation between natural-resources-linked stocks and the broad equity market has moved around over the years. Market dynamics are fluid, and relationships between assets are in a constant state of flux. As seen below, 2022 was a period of dramatic divergence. Raging inflation and the aggressive monetary policy response brought down stocks and bonds simultaneously. Yet even as the Morningstar Global Markets Index (equities) and the Morningstar Global Core Bond Index both declined more than 17% in gross return USD terms, the Morningstar Global Upstream Natural Resources Index advanced 16% over the course of the year.

The US equity market has become concentrated and tech-heavy. Investors holding a broad market portfolio have outsize exposure to a small number of growth stocks riding trends like AI and digitization. Given the declining representation of the basic materials and energy sectors, it’s not surprising that an index of natural-resources-linked equities can behave so differently from the overall market.

Diversification, said to be the only “free lunch” in investing, can also be frustrating. In boom times, investors may question the value of poor-performing assets and regret not being fully allocated to the investment du jour. After all, when diversification is done right, some segments of a portfolio are lagging. Diversifiers are typically only appreciated during difficult periods.

Natural-Resources Investments Can Grow, Too

Artificial intelligence is not the only growth theme in the market. Rising living standards in emerging markets like China and India are changing diets and boosting agricultural businesses. This benefits companies like Archer-Daniels Midland, Corteva, and Nutrien.

Meanwhile, the clean energy transition is increasing demand for minerals. Lithium miners are a critical node on the electric vehicle value chain. Copper and a range of other resources extracted by diversified global mining operations are critical inputs to renewable energy solutions. Companies like BHP, Glencore, and Vale are contributing.

So, the constituents of the Morningstar Global Upstream Natural Resources Index possess growth potential, not just inflation-hedging properties. Dividend income is another benefit of these investments, as returning significant amounts of cash to shareholders through regular payouts is common in the space. Natural-resources-linked equities may not be riding the AI wave, but as a portfolio diversifier, they have real utility.

©2023 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.