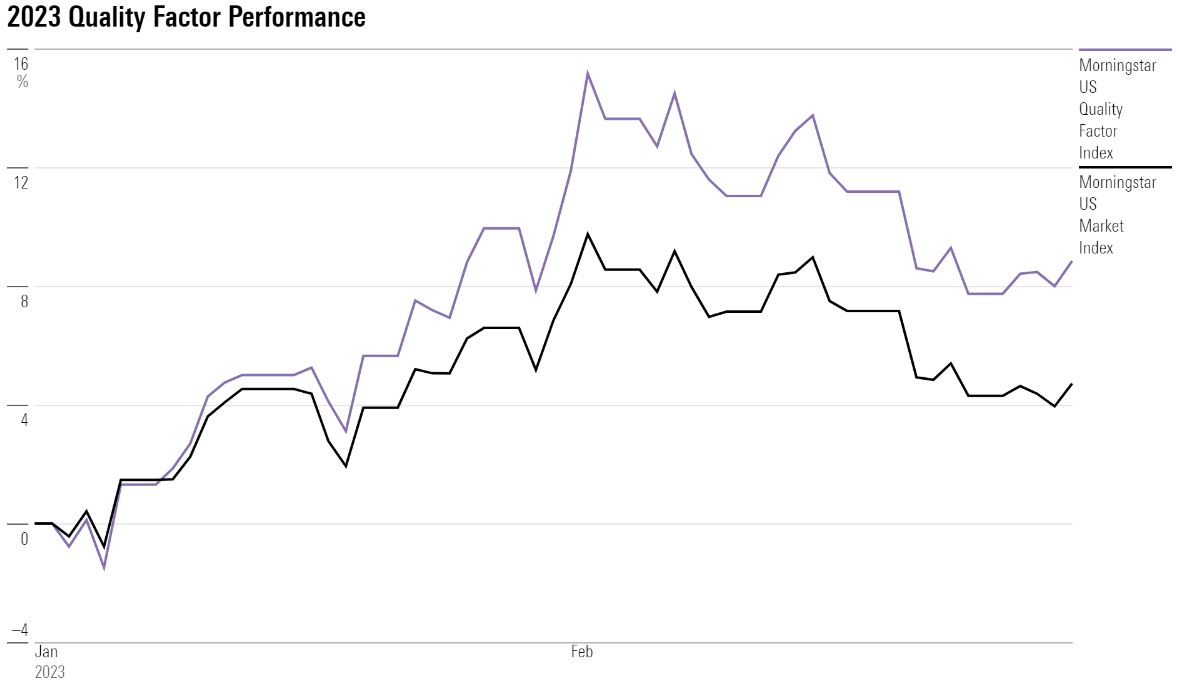

The stocks of high-quality companies have gained twice the returns of the broader US stock market this year so far.

Lucky for long-term investors, Morningstar analysts still see room for growth in several of these profitable, well-governed names, such as Adobe ADBE, Microsoft MSFT, and BlackRock BLK. All of these stocks score highly on Morningstar’s measures of quality.

“Quality” is one of several investment factors commonly known to drive returns for stocks and funds. The stocks of high-quality companies tend to have high profitability and strong balance sheets. Historically, Morningstar researchers say, higher-quality stocks perform better over time than less-profitable and more highly indebted counterparts. They also tend to protect against downturns and be less risky than lower-quality stocks.

The Morningstar US Quality Factor Index—a collection of US stocks with high profitability and low debt/capital ratios—has risen 8.8% for the year through March 2. That’s nearly twice the gain of the Morningstar US Market Index, which rose 4.7% for the same period.