As originally published on Morningstar.com.

Climate change presents a challenge—as well as an opportunity—for every investor. It affects every company in every sector of the economy. In response, we are in the early stages of a transition to a low-carbon economy. That makes climate indexes an increasingly important part of climate investing.

To avoid the worst impacts of climate change, scientists at the International Energy Agency and the Intergovernmental Panel on Climate Change cite the necessity of limiting atmospheric warming to no more than 1.5 degrees Celsius compared with preindustrial levels (reflecting the period 1850-1900).

That goal involves achieving net-zero emissions by 2050. This means balancing the amount of carbon dioxide released into the atmosphere with the amount removed. Emissions can be removed by natural means (like carbon sinks such as forests and oceans) and by other emissions-reduction technologies. For example, substituting renewable and nuclear energy for fossil fuels that generate greenhouse gas emissions, electrifying industrial processes, and increasing energy efficiency, are all emissions-reduction strategies. However, since it is unrealistic to expect that we can eliminate all carbon emissions, the goal of net zero is to achieve this equilibrium.

Strategies related to the transition to a low-carbon economy are gaining momentum with investors. Morningstar’s Voice of the Asset Owner Survey 2023 revealed that institutional investors view environmental issues, particularly achieving net zero, as financially material. A recent Morningstar study identified more than 1,400 climate-oriented open-end and exchange-traded funds with more than $534 billion in assets (as of June 2023). The US share of that market was 117 funds with $31.7 billion, with the majority of funds and assets in Europe. This coverage of climate funds spans both equity and fixed-income asset classes. Most of the ETFs are index-based passive funds.

Investing in Times of Climate Change

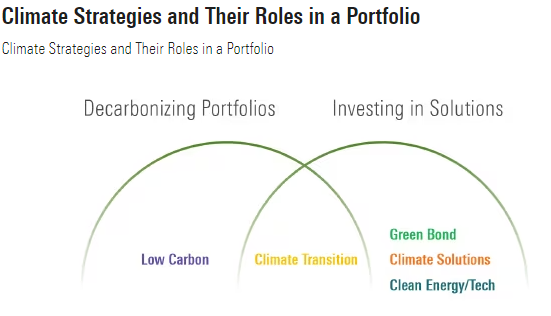

Investors considering climate investing face a broad set of choices. The good news is that there are tools for making sense of climate-related investment options. Morningstar’s classification of climate strategies (see Exhibit 1) defines investor options along a spectrum from decarbonizing portfolios to investing in solutions, defined as green bonds, climate solutions, and clean energy/tech. In the middle are climate-transition strategies, which bridge the two ends of the continuum, taking into account how companies are faring on their net-zero commitments and activities that generate green revenue.

Who Wins and Who Loses in the Carbon Transition

There will surely be winners and losers in the transition to a low-carbon economy, but the transition isn’t linear. So, it’s a complex challenge for investors to identify which companies stand to gain and which may suffer. The process depends on public policy, market outcomes, technological development, and consumer behavior.

How Climate Indexes Help

Conventional broad market indexes expose investors to the full gamut of the climate transition, owning both the winners and the losers. Investors who have convictions about the climate transition may seek investments that respond to these long-term risks and opportunities.

Climate indexes can help in this process. But even these come in many shapes and sizes and are evolving in their approach based on advances in our understanding of these issues. Since the first sustainability index was launched in 1990, indexes have reflected the evolving strategies of sustainable investors. In addition to codifying new strategies, these benchmarks equip investors with information about risk and return and support rules-based, transparent and cost-effective investments for managing risks and opportunities associated with climate investing.

The Evolution of Climate Investing

Climate investing began with the launch of a renewable energy index 20 years ago and has progressed along with climate science, technological advances, and the availability of new data.

The first climate index, the WilderHill Clean Energy Index, launched in 2004. Focused on climate solutions, it offered investors targeted exposure to the potential upside of the transition through renewable energy—for example, solar and wind power—and clean energy technology. Climate solutions are thematic investments typically having fewer constituents and lower diversification. They are more volatile than broad market climate strategies like low-carbon or climate-transition indexes. Over the years, renewable energy index funds have been very volatile. For example, the Invesco WilderHill Clean Energy ETF (PBW), whose benchmark is the WilderHill Clean Energy Index, gained 204.83% in 2020 but had negative returns totaling over 94% from 2021-23.

The second stage of climate investing reflected the growing interest of investors in divesting from fossil fuels, leading to the creation of ex-fossil fuel indexes. Portfolio decarbonization can be achieved by reducing or eliminating oil, natural gas, and coal assets. Ex-fossil fuel indexes exclude companies that own or extract fossil fuel reserves, while low-carbon strategies seek to reduce exposure to fossil fuel assets through a combination of exclusion and underweighting. An example of an ex-fossil fuel benchmark is the Morningstar Global ex-Fossil Fuels Index.

Next came climate-transition indexes, benchmarks designed to provide exposure to companies with business strategies that aim to achieve net zero, or solutions providers whose technologies, products, or services facilitate the transition. The index may select best-in-class companies or overweight those making progress in reducing their carbon emissions. One of the first climate-transition indexes is based on standards set by the EU for Paris-Aligned Benchmarks—for example, the Morningstar Global Markets Paris Aligned Benchmark Index. Morningstar is also working on a new index series focused on climate-transition leaders—companies that are poised to facilitate the transition to a low-carbon economy or are positioned favorably in the transition relative to their peers.

Climate Investing Isn't ESG Investing

It is important to remember that climate investing is not the same as environmental, social, and governance investing. Climate investing focuses on reducing exposure to carbon emissions or seeking opportunities associated with transition to a low-carbon economy. While some climate indexes may account for ESG risks and opportunities, they are not the primary determinant of selection or weighting of index constituents. It is also worth noting that some companies providing climate solutions may be relatively carbon-intensive but are sought out by investors because the technology they provide contributes to the transition to a low-carbon economy.

Just as climate transition and pathways to net zero are evolving, the approaches that investors can take to address climate change are evolving and becoming more sophisticated. Whether it’s about protecting your portfolio against the growing risks or positioning your portfolio to take advantage of the potential investment opportunities from climate change, indexes can be a helpful map for investors to navigate a dynamic and potentially confusing climate landscape.

©2024 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.