It was a tumultuous period for markets in 2022 as a variety of factors weighed on investors. In leveraged loans, risk aversion led to a secondary market sell-off and strangled the new-issue market, stifling refinancing opportunities and stranding committed LBO financing that arranging banks struggled to get off their books.

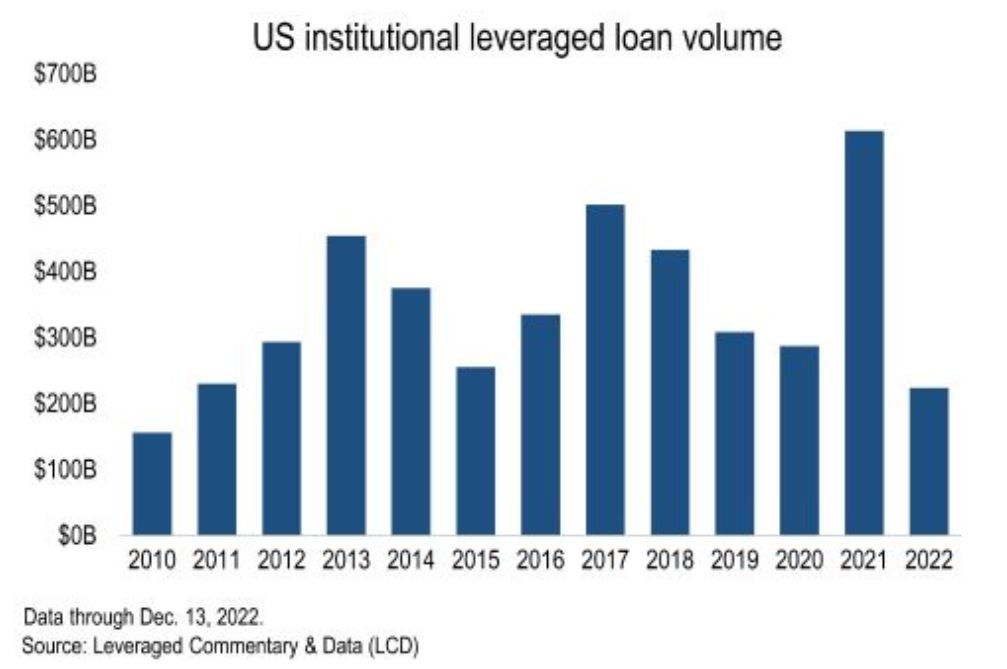

Total new-issue volume in the broadly syndicated loan market tumbled 63% to a 12-year low of $225.1 billion, as deal flow dried up on all fronts amid market volatility. Demand softened over the course of the year, as CLO origination was slower in the second half and cash outflows from retail funds accelerated.