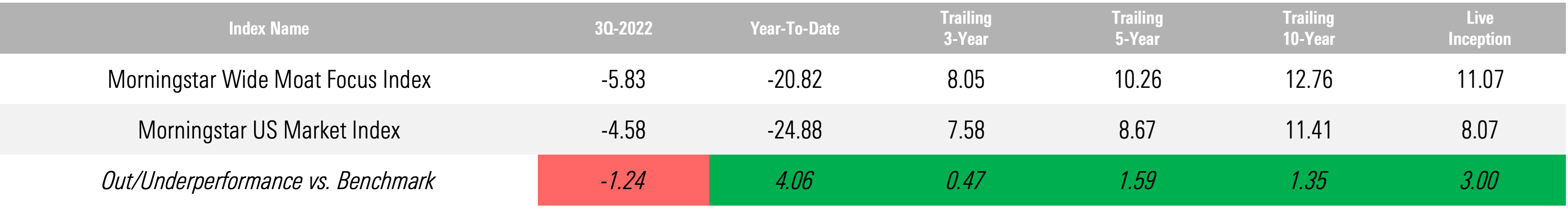

In the third quarter, the Morningstar Wide Moat Focus Index modestly underperformed its benchmark, the Morningstar US Market Index, as the broad market continued to grind lower.

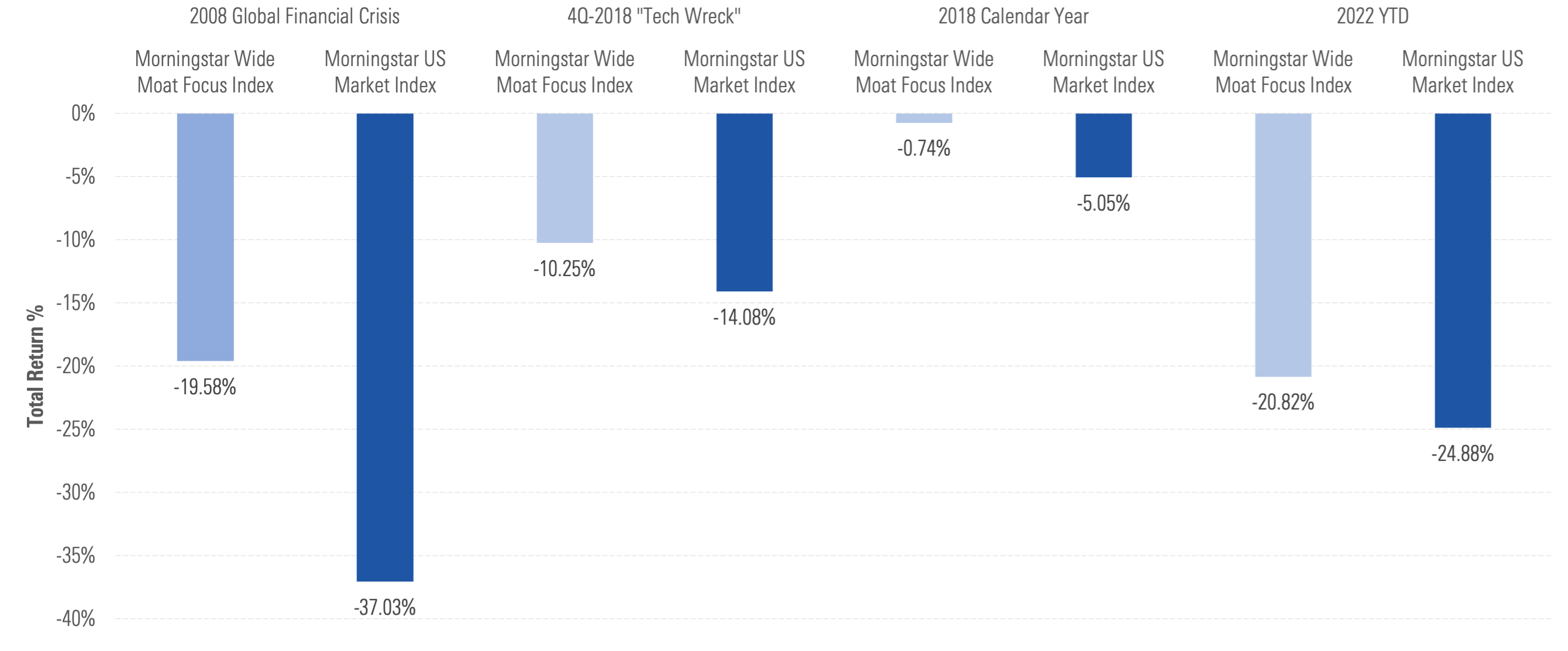

Despite underperformance in the third quarter, the Morningstar Wide Moat Focus Index has still provided meaningful downside protection year-to-date. Through the end of September, the Index delivered a -20.82% total return versus -24.88% for its benchmark. This is consistent with the Index’s historical performance amid prior market pullbacks.

Stock selection proved unfavorable, driving a larger share of underperformance than sector positioning. Granted, given the index’s use of forward-looking analysis from Morningstar equity analysts in determining economic moats and fair value estimates, stock selection will prove more beneficial in some quarters than others. Indeed, favorable stock selection has explained the majority of excess returns since the index’s live inception date, which goes all the way back to early 2007.

Indeed, the Morningstar Wide Moat Focus Index has exhibited a downside capture ratio of 85.75 on a quarterly basis since inception, indicating that it has held up much better than its broad market benchmark when the market has traded lower. The Index isn’t purely “defensive” in nature, however, as its quarterly upside capture ratio of 106.92 over the same time period indicates that it has also outperformed when the market has moved higher.

Another key observation regarding year-to-date performance is that the Morningstar Wide Moat Focus Index, which employs a screen for US wide moat-rated companies along with a valuation screen, has soundly outperformed the Morningstar Wide Moat Equal Weighted Index, a basket of US wide moat-rated companies with no regard for valuation (-20.82% vs. -23.05%). Accordingly, the valuation analysis provided by Morningstar equity analysts in identifying undervalued companies as well as overvalued companies has proven highly beneficial this year.

The index’s outperformance versus the broader market has also been concurrent with the underperformance of historically defensive strategies focusing on quality as a factor. While quality factor-based strategies have traditionally provided an even greater degree of downside protection than the Wide Moat Focus Index, they have mostly underperformed the broad market this year.In part, this is because they tend to be market cap-weighted and most hefty weightings in quality “big tech” companies this year have led to subpar returns. This speaks to the importance of the Morningstar Wide Moat Focus Index’s equal-weighted design, which allows the benefits of stock selection to propagate through the market cycle without the Index’s return profile being anchored to the fortunes of a small number of “big tech” companies.

Amid the prospect of further rate hikes and persistent inflation, the investment landscape remains perilous. However, we’re optimistic that the volatility observed in recent months will allow the Morningstar Wide Moat Focus Index to take advantage of market dislocations that might not otherwise exist. Additionally, given the historical versatility of the Index, as reflected by its legacy of outperformance in both up and down markets, we’re hopeful that the Index will continue to serve investors well no matter what market conditions lie ahead for equity investors.

©2022 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.

Investment research is produced and issued by subsidiaries of Morningstar, Inc. including, but not limited to, Morningstar Research Services LLC, registered with and governed by the U.S. Securities and Exchange Commission.