“The death of diversification” was declared in 2022 when stocks and bonds sold off in tandem. Previous bear markets for equities, including the pandemic-driven crash in the first quarter of 2020 and the global financial crisis of 2007-09, saw the Morningstar US Core Bond Index in positive territory, benefiting from a flight to safety and quantitative easing. But fixed income failed in its role as portfolio ballast last year. The aggressive monetary response to persistent inflation sent bond yields up, bond prices down, and Morningstar’s broadest gauge of the debt market falling 13%, an unusually painful drawdown for the asset class.

Few are celebrating the negative correlation between stocks and bonds this year. The broad US equity market has risen nearly 10% for the year through October, but the core bond index has fallen nearly 3%. Rising interest rates have continued to plague debt instruments. The yield to maturity on the core bond index has climbed from 4.5% at the start of the year to 5.6% on Oct. 31.

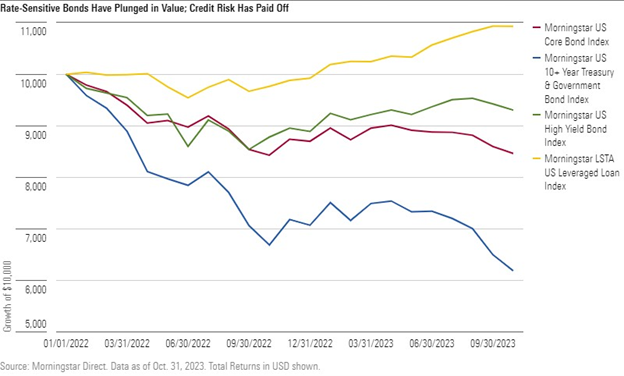

Yet a more granular look at fixed income reveals pockets of real strength. While the core bond index and the even more interest-rate-sensitive Morningstar US 10+ Year Treasury and Government Bond Index have taken it on the chin, the Morningstar US High Yield Bond Index has gained nearly 5% for the year through October. Meanwhile, the Morningstar LSTA US Leveraged Loan Index is up more than 11%. Clearly, taking credit risk has paid off for investors, while interest-rate-sensitive areas have suffered.

“Higher for Longer” Weighing on Rate-Sensitive Bonds

The interest-rate hikes that began in March 2022 have continued into 2023. In a belated response to inflation, the US Federal Reserve hiked rates seven times in 2022, four times in 2023, and left the door open for more. With the federal-funds rate 5 percentage points higher than 18 months ago, the yield on the Morningstar US Core Bond Index sits at its highest level since June 2007.

Despite credit conditions that have returned to pre-financial-crisis levels, the US economy has remained remarkably resilient. Gross domestic product growth reached nearly 5% in the third quarter, inflation persists, and the labor market is robust. The “full effects of tightening are yet to be felt,” said Fed chair Jay Powell.

As a result, expectations have reset. The debate that raged earlier this year over whether the imminent recession would be a “hard” or “soft” landing has quieted. A yield curve that had been deeply inverted in anticipation of an economic slowdown has become less so, as longer-term interest rates climb.

The “higher for longer” narrative around rates has weighed heavily on interest-rate-sensitive bonds. Thanks to the steepening of the yield curve, Morningstar’s long-term US bond index has declined more than 13% this year, coming off a brutal 30% drop in 2022. The Morningstar US Core Bond Index, which is composed of nearly half Treasurys by market value, lost more than 5% in the three months through Oct. 31.

A Resilient Economy Is Good for Credit

Yet the same forces that have pushed rates higher have buoyed credit-sensitive sections of the market. The Morningstar US High Yield Bond Index, which measures the universe of corporate debt rated BB or lower, has posted a healthy gain this year. Many companies took advantage of low rates during the pandemic to refinance debt. Default rates have been low, boosted by the economy’s strength.

Leveraged loans, for their part, are one of the best-performing asset classes of 2023. The Morningstar US LSTA Leveraged Loan Index’s yield to maturity stood at 10.6% as of October’s end, and those high yields—coupled with low default rates—have boosted investor demand. With primary issuance down in 2023 compared with the previous year, and refinancings accounting for much of the year’s activity, the secondary market has strengthened. Leveraged loans are on pace for their strongest year since the global financial crisis.

A Brighter Future for Fixed Income?

Times are good for income investors. The 5.6% yield on the Morningstar US Core Bond Index is higher than at any point since the global financial crisis, before years of Zero Interest Rate Policy to stimulate a moribund economy. With inflation a greater risk than deflation, fixed-income investors can finally clip healthy coupons. For those willing to take on credit risk, the rewards are even greater.

Higher yields are also beneficial for investors not immediately looking to their portfolio for a regular paycheck. Reinvested coupon payments contribute to total return. The starting point from a yield perspective is now substantially higher than it was 18 months ago, raising long-term return assumptions for fixed-income portfolio allocations.

From a diversification perspective, it’s important for investors to remember that credit-sensitive instruments have tended to be more equitylike in their behavior. The fact that high-yield corporates and leveraged loans have thrived in 2023, a positive year for equities, reinforces this link. Historical volatility for both asset classes, while below the level of stocks, far exceeds that of Treasurys.

Neither high-yield corporate bonds nor leveraged loans have demonstrated safe-haven attributes in past instances of market stress. Neither has ever been referred to as “portfolio ballast.” They are far more speculative than Treasurys. That said, one of the lessons of 2022 is that correlations between assets are dynamic. Diversification across stocks and fixed income of different types is a sensible long-term strategy but won’t always benefit investors in the short term.

©2023 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.