In January, I escaped the Chicago winter to India. I spent a week in Morningstar’s bustling Mumbai office, then attended two weddings: the first a Bollywood-style north Indian affair, the second in tropical Kerala. Some things haven’t changed since I first visited the country in 1998. The roads are still chaotic, and the air smoky. The curries are as flavorful as ever, the people endlessly warm.

On the digital and mobile fronts, though, I was blown away by the changes since my last visit in 2018. I watched passengers breeze through airports with biometric scans. I witnessed convenience store transactions in remote rural areas conducted with a wave of a mobile phone and a chime. And when a traveling companion announced he was short on underwear, our local colleagues opened an app, and a motorbike appeared 15 minutes later to deliver fresh skivvies.

In this week’s column, I’m taking a deep dive into the Indian investment opportunity. In recent years, India has been a bright spot in the emerging-markets equities landscape, with the Morningstar India Index providing a lens into the market’s dynamism. India has defied global trends by becoming less technology-oriented and more domestic in its revenue sources. It’s undoubtedly an exciting growth opportunity, though not for the faint of heart. Case in point: the Morningstar India Index declined more than 20% in US dollar terms from the start of 2024’s fourth quarter through the end of February, and our small and mid-cap Indian equities benchmark fell even further. In an interview for The Long View podcast, portfolio manager Sudarshan Murthy of GQG Partners told us the pullback was a long-term buying opportunity.

India: An Emerging Markets Bright Spot – Until Recently

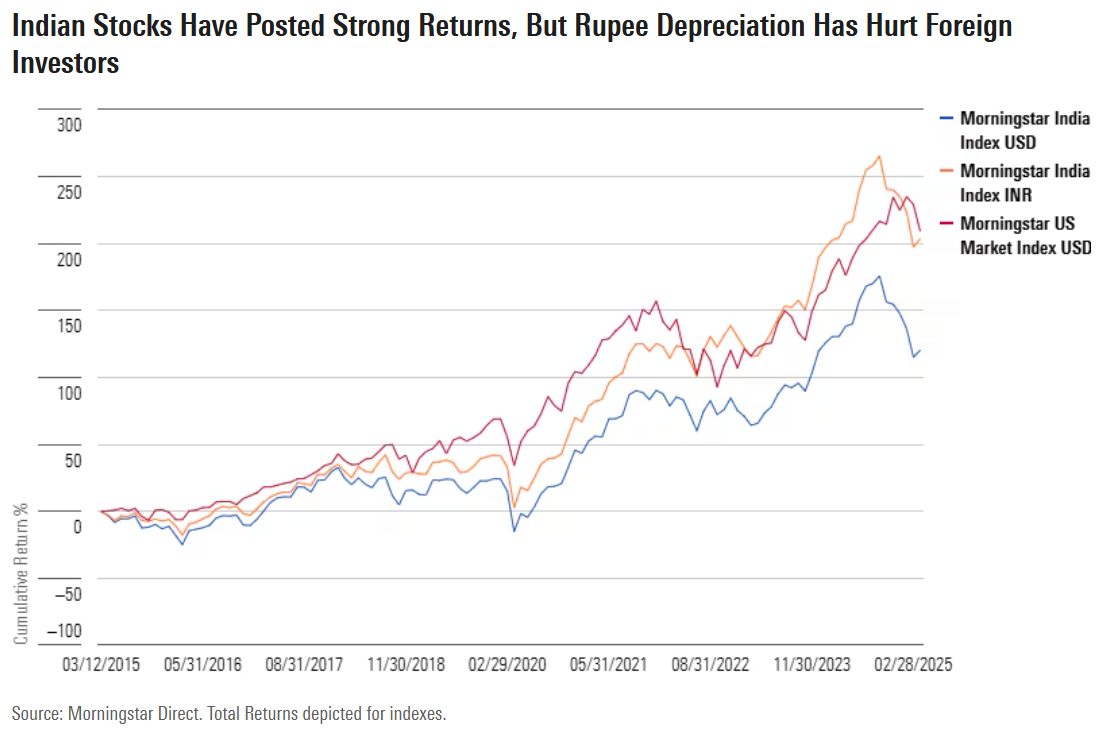

I should say at the outset that I have been an investor in Indian stocks for years. I bought an India-focused exchange-traded fund in 2012 after returning from a visit brimming with enthusiasm (Can you tell I’m an Indophile?). It has performed well, but I would have done better owning a broad US equity market index-tracking fund. As displayed below, the Morningstar India Index has produced similar returns to the US in rupee terms over the past decade, but when converted into US dollars, those gains diminish.

The Indian stock market has grown in stature in recent years, though, benefiting domestic investors most. When I pointed out all the Range Rovers I’d seen in the snarled Mumbai traffic, a local colleague replied: “Some people have made a lot of money in the stock market.” India is now the second-largest country allocation in the Morningstar Emerging Markets Index, its 18% weighting as of the end of February surpassed only by China’s 27% share. While Indian equities represent just 2% of the Morningstar Global Markets Index, that’s higher than Germany, Australia, and South Korea. Active portfolio managers have shifted assets in recent years from China to India, as many came to view China as “uninvestable” and India captured the imagination.

Most will be familiar with the key pillars of the Indian growth story. India overtook China in 2023 as the world’s most populous country; its relative youth constituting a massive “demographic dividend.” The Indian workforce is known for technological prowess, English proficiency, and entrepreneurial zeal—with Morningstar’s Mumbai office of more than 4,000 employees a case in point. Gone is talk of a “Hindu Rate of Growth” as if there were cultural barriers to economic development, and complaints have faded about the “License Permit Raj”—bureaucracy entangling business activity. Many credit Prime Minister Narendra Modi, in power since 2014, for infrastructure development, digitization initiatives, growth in inter-state trade, and deregulation. It’s not just about Modi, though. Market-oriented reforms have progressed since 1991 under governments of various stripes.

Crucially for investors, India’s private sector has profited from the positive macro backdrop. Murthy told us corporate earnings growth has not been far off US levels in recent years. Among the top constituents of the Morningstar India Index are highly profitable businesses Reliance Industries 500325, banks HDFC 500180 and ICICI 532174, and consumer cyclical Mahindra & Mahindra 500520. These companies have honed their operating know-how over decades.

But just as monsoon rains interrupt the Indian sunshine, challenges abound. Economic growth has slowed from roughly 7% in 2022 and 2023 to closer to 6% today, with corporate earnings growth also moderating. Infrastructure bottlenecks, inflation, and trade deficits are persistent issues. I was thankful for rupee weakness when shopping for wedding attire in January, but the Reserve Bank of India has expended considerable resources stabilizing the currency. The rupee’s decline partly reflects negative sentiment. Foreign investors especially have become wary. Geopolitical uncertainty is undoubtedly a factor.

A Changed Market

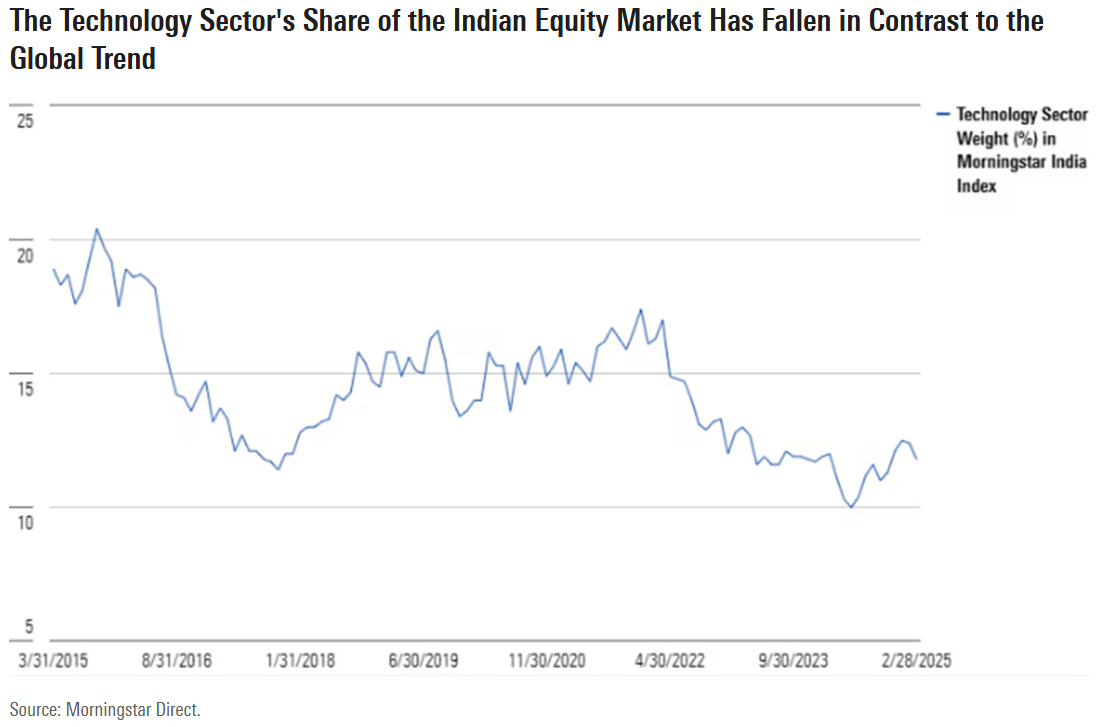

It’s important for investors to recognize how the complexion of India’s stock market has changed. In contrast to the global trend, the Morningstar India Index has seen the technology sector decline in share over the past 10 years. While technology stocks have grown to represent more than 30% of the Morningstar US Market Index, India’s tech sector has declined from 20% of the market in 2015 to just 12% today.

What’s going on? Ten years ago, the largest public company in India was Infosys Technologies INFY, a global provider of IT services. Its competitors Tata Consultancy Services 532540 and Wipro WIT were also prominent constituents of the Morningstar India Index. Those companies are still important. Morningstar equity analysts view them as possessing durable competitive advantages. But more domestically oriented businesses have risen in value: the banks, conglomerate Reliance Industries, Bharti Airtel 532454 in the telecom space, and consumer names. Among the top 20 constituents of the Morningstar India Index is Zomato 54332O, which can deliver lunch (or underwear) within minutes. Backed by venture capital, Zomato conducted its IPO in 2021. The Morningstar PitchBook index focused on Indian “unicorns” includes several more private companies valued at more than $1 billion that could list their shares in the coming years.

Meanwhile, India’s revenue mix has also become more domestic. The Morningstar India Index currently sources 75% of its revenue domestically, whereas in 2021, that figure was 69%. (In contrast, most markets around the world have become more international in their revenues, as we pointed out in our latest annual revenue study of global equity markets.) More domestic sectors like financials and industrials have grown their share, as technology, as well as healthcare, have declined. The Indian market has become more Indian. That’s a positive if you believe in its growth story.

The Indian Investment Opportunity

There’s no shortage of investment luminaries who are bullish on India. Professor Burton Malkiel, author of the classic "A Random Walk Down Wall Street," has compared India today to China going into the 21st century, benefiting from pro-market reforms, abundant labor, and a strong education system. Global supply chain shifts away from China also help India. “You don’t want to miss out on India of the next 10 years,” said famed bond investor Howard Marks on a trip to the country in early 2025.

To long-term bulls, the recent selloff is a buying opportunity. Murthy and his team talk about a “Herd Mentality” when it comes to India investing, with dramatic swings in foreign capital flows based on changes in sentiment. “In our view, investors have been overly concerned about India lately,” writes the GQG team. It views negative recent sentiment as “a contrarian signal to buy.”

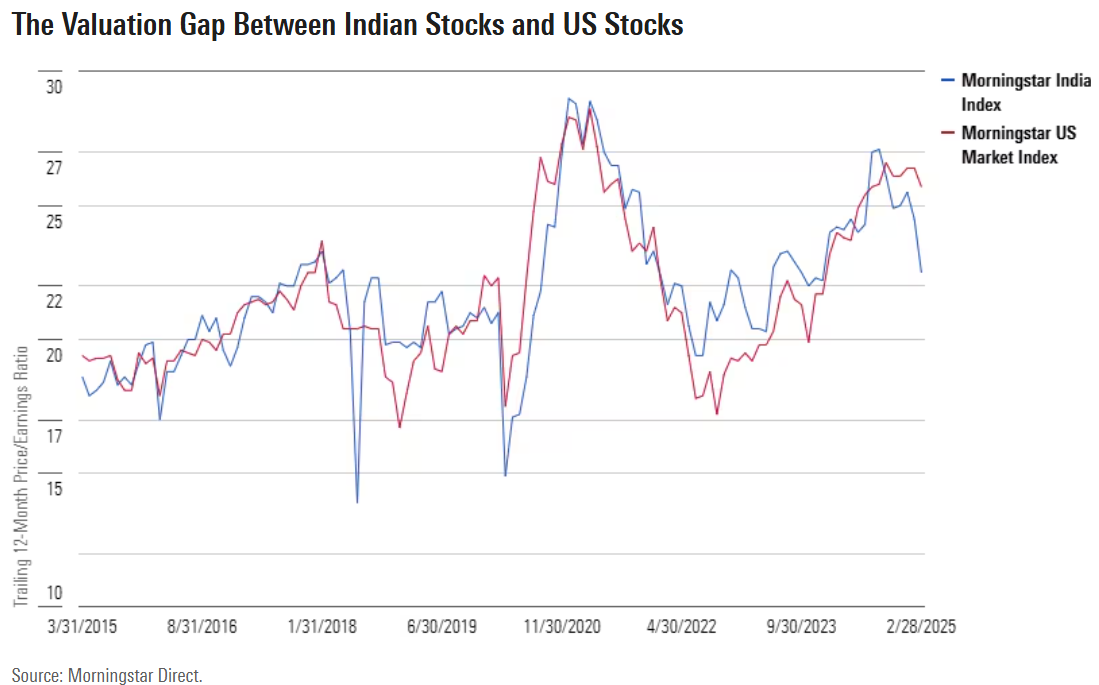

With the recent drop in Indian stock prices, Morningstar Investment Management has raised expected returns from Indian equities. Valuation is critical to its calculus. In 2024, the Indian stock market looked frothy; talk of bubbles, especially in the small- and mid-cap space, was common. Looking at the Morningstar India Index’s aggregate price/earnings ratio versus the US market below, India stocks have often traded at a premium to US stocks over the past decade. When meaningful discounts have opened up in the past, as in mid-2018 and 2020, India has gone on to perform well.

However, investors need to remember that India is a volatile market. In rupee terms, stock prices have bounced around more than US equities, and when you throw in currency effects, India’s stock market has been significantly more volatile. Given the capriciousness of global capital flows, the development of a stronger local investment culture is critical. In talking to locals, I was encouraged to hear about the growth of Systematic Investment Plans. Ads for “Share Market Classes: Trading & Option Strategy” made me nervous.

Every market is unique. India isn’t China, with its mass migration from countryside to city. Nor is it a manufacturing powerhouse. On the other hand, India’s stock market has been much more investor-friendly than China’s. An abundance of well-managed, profitable companies is a huge plus. So, too, is the rule of law. In case you’re curious, I’ve used the recent pullback to add to my India ETF position.

©2025 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.