There may well be more bond market volatility ahead, but higher yields and deeply discounted bond prices could present investors with good opportunities. Here’s a look at what went wrong in 2022, what could go right in 2023, and what to do about it.

It Was Going to Storm . . . Eventually

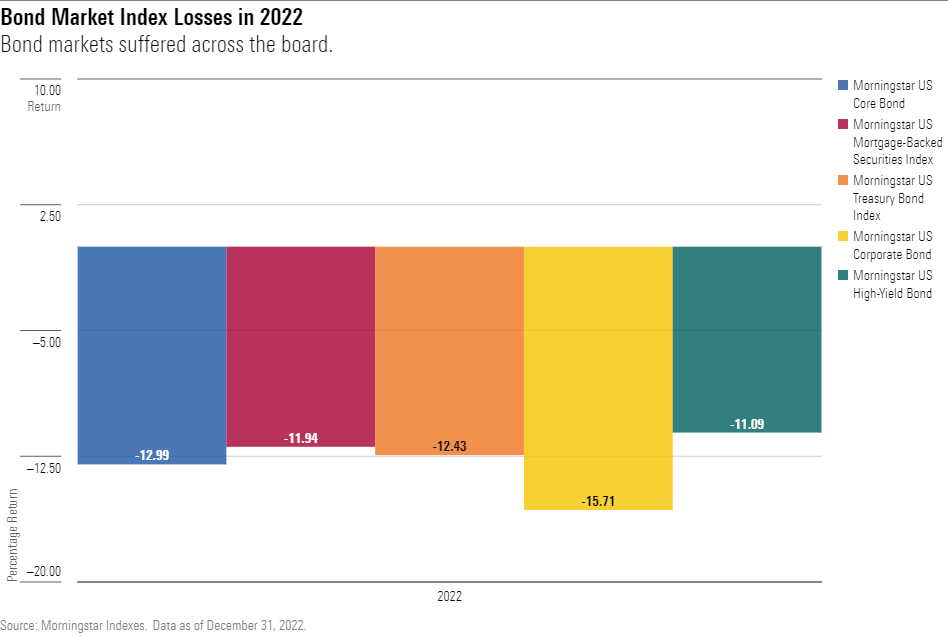

By historical standards, bonds were a debacle in 2022. Instead of holding up as stocks fell, almost every type of bond—from government to junk—posted double-digit losses. The Morningstar US Core Plus Bond Index fell 12.9%.

The fiasco was not entirely unforeseeable. Even if it would have been hard to predict the confluence of a global supply chain coronavirus hangover with Russia’s invasion of Ukraine, many bond managers had long worried about the possibility of a stagflation-driven recession scare and a bond market rout.