Does anyone else have déjà vu all over again? “We’ve Seen a Postelection Small-Value Rally Before,” I wrote in November 2020. That month saw Joe Biden’s victory and a powerful rally among US small-cap stocks, with value leading growth. The Morningstar US Small Value Index was also the top-performing Morningstar Style Box segment after Donald Trump’s victory in 2016.

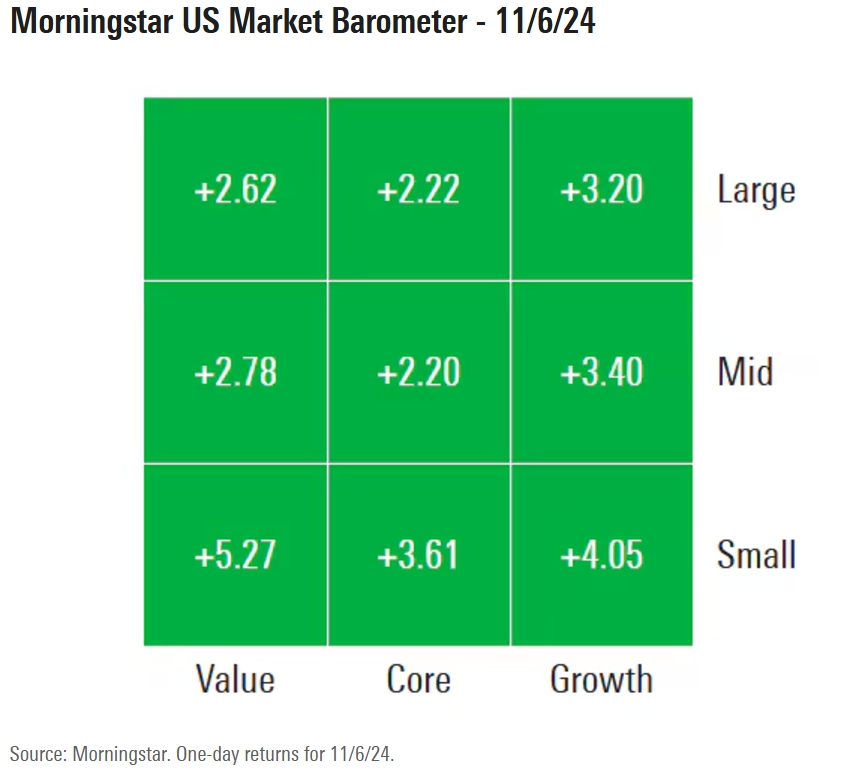

Another presidential election, another small-cap rally. Trump was declared the victor on Nov. 6. The Morningstar US Market Barometer following the close of trading that day looked like this:

Clearly, small caps are one of this year’s “Trump Trades,” along with the US dollar, cryptocurrencies, and rising bond yields. But this was the third straight postelection small-value rally. “History doesn’t repeat, but it does often rhyme,” as attributed to Mark Twain.

In that spirit, I can’t help but wonder whether the current postelection small-cap rally will fizzle just like its predecessors did. Yet there are reasons for investors to consider this unloved asset class that have nothing to do with politics. Sometimes it is different this time.