US stocks are looking expensive. When company-level price/fair value estimates assigned by Morningstar equity analysts are aggregated, the broad market lands in overvalued territory. It’s a consequence of an incredible rebound from the tariff-induced selloff of early April.

What’s a price-conscious investor to do in these circumstances? One answer is to take a selective approach to US equities. The Morningstar Wide Moat Focus Index includes competitively advantaged companies trading at attractive valuations in the eyes of Morningstar Equity Research.

Great businesses aren’t typically cheap. Sometimes, though, short-term issues create long-term opportunity. Negative sentiment can punish a company’s stock price for reasons that are ultimately fleeting, giving investors the chance to buy a wide-moat business at a discount to intrinsic value.

I decided to explore the topic with the help of my colleague Andrew Lane, who follows the Wide Moat Focus Index closely. Below are three historical index constituents that entered the index after bad news depressed their share prices. All saw recoveries, their wide moats supporting excess returns over time. I’ll also share a few current index constituents Lane identified that look like investment opportunities, despite being clouded in controversy.

Equifax EFX

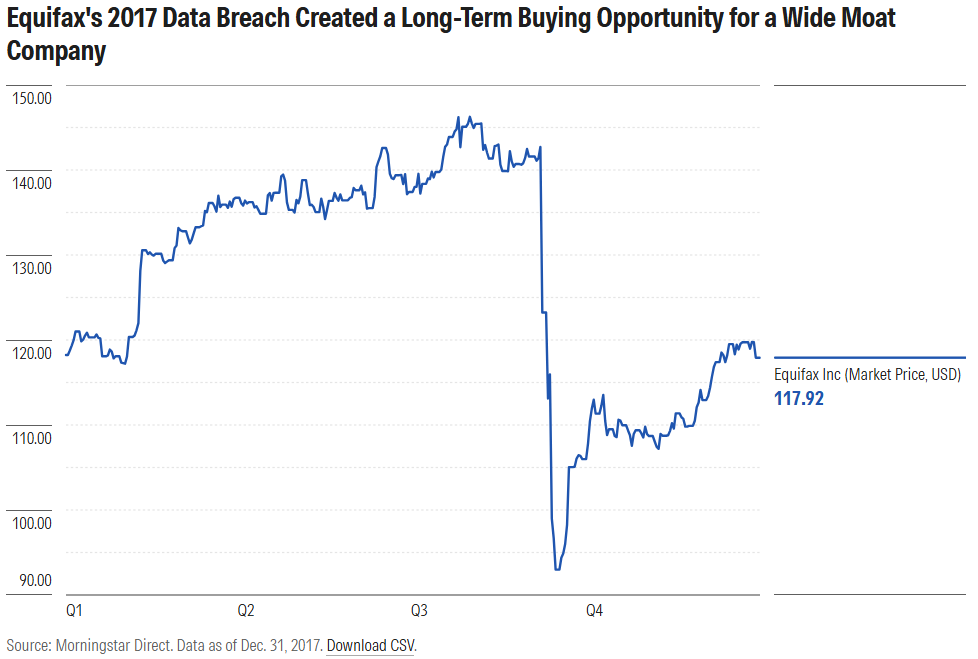

Equifax is one of the Big Three US credit bureaus. Lenders rely on Equifax and its competitors to assess borrowers’ creditworthiness. Morningstar Equity Research assigns the company a wide economic moat based on its intangible assets. Equifax’s data is critical to lending decisions, and barriers to entry are high in the credit rating business. A massive data breach in 2017 called the company’s standing into question.

Writes Morningstar analyst Rajiv Bhatia:

“Equifax’s reputation took a beating after a well-publicized data breach in 2017. This wasn’t the first time Equifax had suffered a data breach; however, the depth and breadth of the breach created ire among the public and showed that the company wasn’t prepared to handle customer data securely.”

Looking at a 2017 stock price chart, it’s clear when Equifax ran into trouble. At the time, the tricky part was determining whether the breach was a short-term setback or a structural challenge. Morningstar fell in the latter camp: “The impact of the recent data breach will dominate near-term results, but we believe Equifax’s entrenched position will allow it to weather the storm.”

The company has met the criteria for Wide Moat Focus Index inclusion at several points in recent years, entering and exiting based on its price/fair value ratio. The stock most recently exited the index in June 2025.

Meta Platforms META

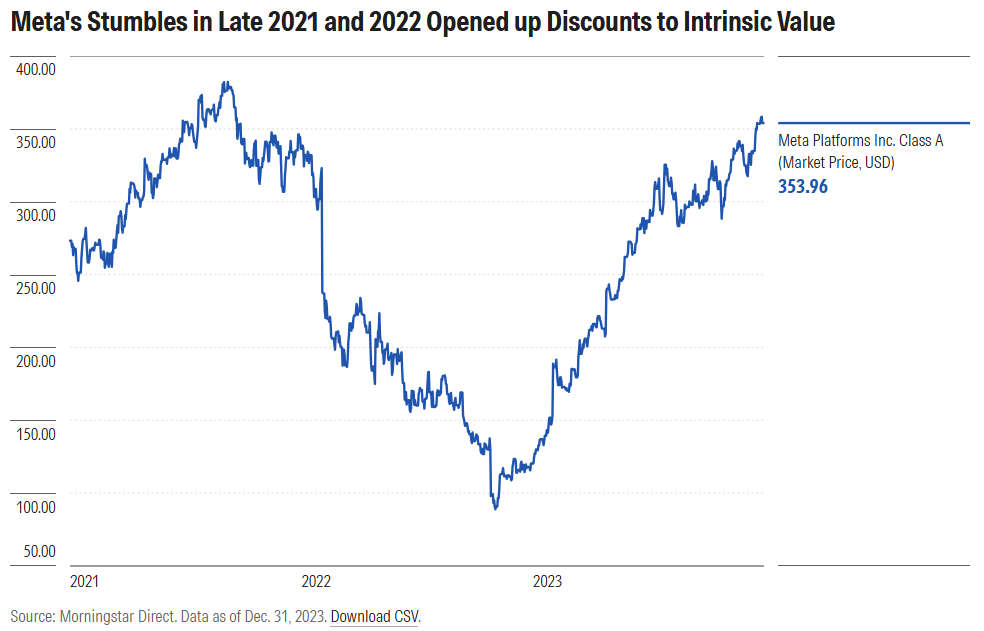

The company formerly known as Facebook enjoyed a meteoric rise, from a Harvard dorm room in 2004, to the largest ever tech IPO in 2012, to the world’s fourth-most valuable public company in mid-2021. The pandemic only benefited the company.

But starting in the fourth quarter of 2021, the tide started to turn. An outage on the company’s digital properties sent the stock price down 5% in a single day. A rebrand to Meta Platforms to reflect a bet on the next digital frontier was met with investor skepticism. Then came changes to privacy settings in Apple’s iOS operating system, undermining Meta’s ability to target and measure advertising. The financial impact was measured in the billions. In 2022, the company’s share price fell more than 64%. By November of that year, the company announced it would eliminate 11,000 jobs.

Yet, Morningstar Equity Research was not rattled. “Meta Platforms’ Network Effect Moat Source Remains Intact,” concluded the analysts. At the end of the day, the firm still boasted 3 billion monthly active users, making it extremely valuable to advertisers.

Amid these controversies, the Morningstar Wide Moat Focus Index included Meta Platforms from March 2021 through September 2023.

Monsanto

If you remember this name from before its 2018 acquisition by Bayer BAYRY, you know it was no stranger to controversy. The crop sciences business was shunned by some for producing genetically modified seeds. Then there was the Roundup, the herbicide alleged to cause cancer. Legal proceedings tied to these controversies and others have been a significant drain on cash flows, with a 2020 Roundup-related settlement costing the company more than $10 billion.

Morningstar Equity Research consistently viewed Monsanto as a wide moat business, though, and included it in the index at several points, often exiting after share price appreciation. After the Bayer acquisition, the company became ineligible for index inclusion, though. Bayer is a German company, and the Morningstar Wide Moat Focus Index considers only US stocks. Bayer also carries a no-moat rating.

9 Wide-Moat Stocks Clouded in Controversy That Look Attractive Today

Lane identified nine current constituents of the Morningstar Wide Moat Focus Index facing a clear set of issues dragging down their share prices. (Other companies in the index might be undervalued because the market is underestimating their ability to generate excess returns.) Below is a list of the nine, the reason(s) for negative sentiment, their current price/intrinsic value (1.00 represents fairly valued), and the source of their wide moat, in the view of Morningstar equity analysts.

As seen from the table, some of the controversies faced by index constituents are company-specific. Boeing’s BA safety issues, Estee Lauder’s EL family leadership, and Bristol-Myers Squibb’s BMY patent cliff are idiosyncratic in nature.

But the majority of the issues listed above are systemic. Concerns over the effect of tariffs have dragged on many companies’ share prices, as has speculation over the effects of obesity drugs depressing consumer demand for food and beverage items. In the cases shown above, Morningstar analysts think concerns are overblown and wide moats are intact. Stock prices, the thinking goes, should eventually converge with intrinsic values.

How to Buy Stocks Selectively

Investors are naturally drawn to companies benefiting from growth trends, like artificial intelligence or robotics. Even professional money managers find it far more comfortable to own thriving businesses than those facing challenges. As Keynes once said: “It is better for reputation to fail conventionally than to succeed unconventionally.”

But markets are discounting mechanisms. Investors must always ask how much growth is already priced in. Great assets are only great investments if you don’t overpay.

The trick is knowing whether bad news is a temporary setback or a long-term structural challenge. Often, when markets punish a stock price, it’s for good reason. But sometimes, it’s an overreaction. Manic swings between optimism and pessimism can open up an entry point for patient, long-term investors. In a pricey US stock market, negative headlines can create a valuation-driven opportunity.

©2025 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.