The Takeaway

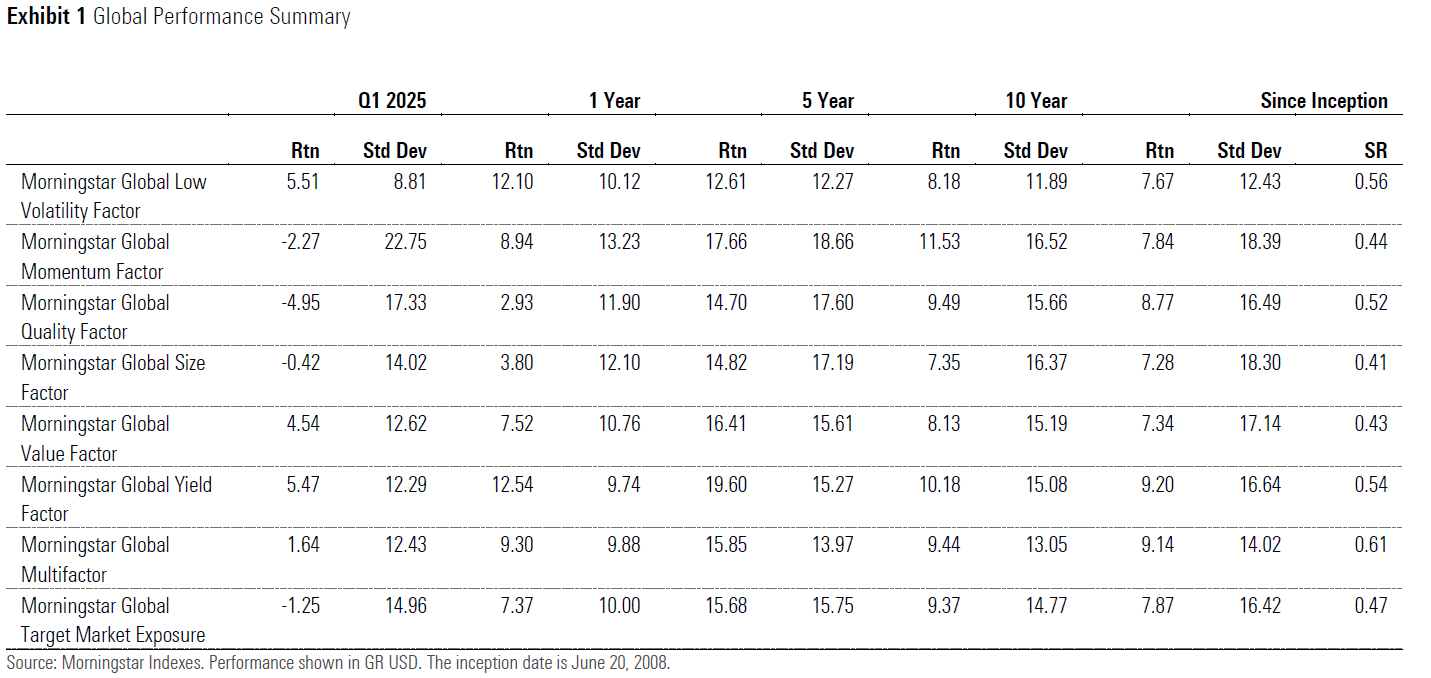

As the specter of a trade war grew in the first quarter of 2025, the more defensive low-volatility and yield factors tended to outperform both the market and other factors. That trend was observed globally as well as in the US.

The value factor beat the market across all regions covered in this report in the first quarter. This marked a sharp turn in the US, where value steeply underperformed in 2024.

Quality and momentum were among the worst-performing factors in the first quarter of 2025, but among the best-performing in 2024. Sharp reversals in market direction create a headwind for momentum, but all factors experience performance cyclicality. Because of their volatility, it is difficult to effectively time factor exposures.

The underperformance of quality might come as a surprise, as investors might expect quality stocks to be more resilient to market turbulence than most. However, historically, the Morningstar Quality Factor Indexes exhibited a similar level of risk to their parent benchmarks. In the first quarter, the Morningstar Global Quality Factor Index was hurt by unfavorable intra-sector stock exposure, particularly in the healthcare, communication services, and technology sectors. Sector tilts did not have a significant impact, as those are tightly constrained relative to the parent benchmark.

Momentum's poor performance might come as less of a surprise. Momentum has historically tended to struggle in periods of high market volatility, as performance leadership is less likely to persist when the market changes direction. For example, during the late stages of a market rally, momentum tends to favor procyclical stocks, which often underperform during market corrections. Following a strong year for global stocks in 2024, the Morningstar Global Momentum Factor Index tilted toward more cyclical names, which created a headwind as market volatility picked up.

The Morningstar Global Yield Factor Index benefited from favorable intra-sector stock exposure, particularly in the consumer cyclical, healthcare, and technology sectors. Sector tilts were not a significant contributor to the yield factor index's performance since this index applies tight sector constraints relative to its parent benchmark.

The Morningstar Global Low Volatility Factor Index allows for greater sector tilts relative to its parent benchmark, which contributed to its strong performance, including its overweighting in the financial services and consumer defensive sectors, and underweighting of the poor-performing technology sector. Favorable intra-sector stock exposure also helped.

©2025 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.