I’m not breaking any news by telling you that stock investors have faced tricky conditions in 2025. Nor would I raise eyebrows with a statement like: “In uncertain times, you want to own quality. Profitable businesses with fortress balance sheets are best positioned to withstand market turbulence and economic downturns.”

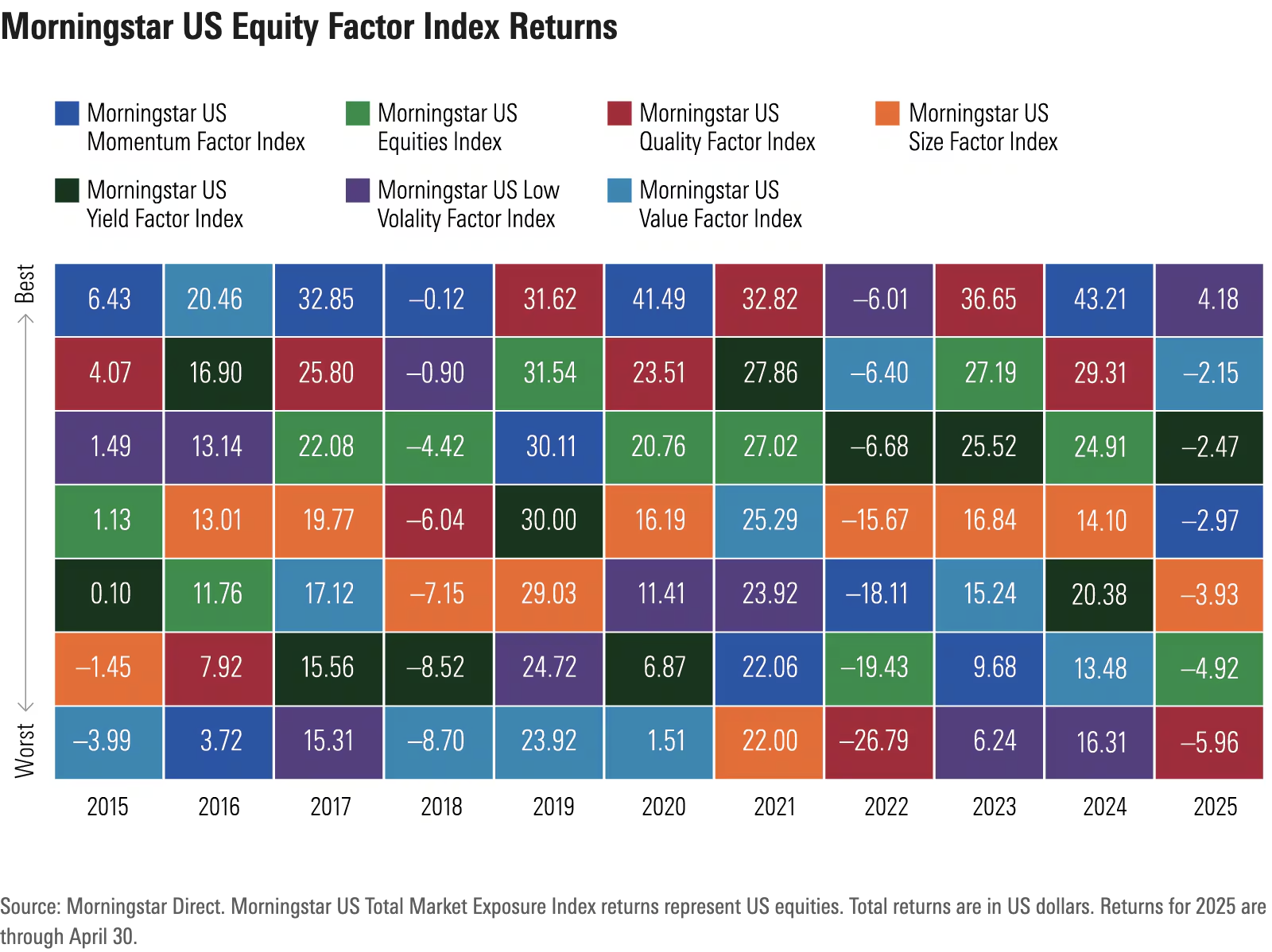

However, that narrative isn’t supported by the data. “Quality” companies may have a reputation for resilience, but they have not held up well in 2025. Have a look at the table of returns for the Morningstar Factor Indexes, and you’ll see quality at the bottom this year, underperforming the broad market through the end of April. Low volatility is the only factor in positive territory, as I’ve covered previously.

Quality doesn’t look any better if you define it through the Morningstar Economic Moat Rating. Whereas the quality factor index screens on backward-looking measures like return on equity and debt/capital, Morningstar’s moat rating is an analyst-driven assessment of future profitability. The Morningstar index of US companies with wide moats, which held up well during the “pandemic panic” of 2020, is down more than the broad US equity market this year.

Why are quality stocks lagging? It’s useful to open the hood and examine the nature of quality investing from both holdings-based and returns-based perspectives. Like all bets against the market, quality goes through performance cycles. And, as with anything in investing, valuation matters.

Quality Is Job One

My Morningstar Indexes colleague Alex Bryan, who has forgotten more about investment factors than I’ll ever know, notes the paradox behind quality stocks’ struggles this year. In a factor monitor for the first quarter of 2025, Bryan writes: “The underperformance of quality might come as a surprise, as investors might expect quality stocks—firms with strong profitability and balance sheets—to be more resilient to market turbulence than most. However, historically, the Morningstar quality factor indexes exhibited a similar level of risk to their parent benchmarks.”

The theory behind the “quality factor” is that the market underestimates the ability of certain companies to sustain strong cash flows. Academic research associates quality stocks with a historical performance advantage. The Morningstar US Quality Factor Index selects companies with strong returns on equity and low debt/capital ratios relative to sector peers. Factor performance, not sector bets, is meant to drive the index’s relative returns.

Quality stocks have performed brilliantly in recent years. The Morningstar US Quality Factor Index was one of only two members of the factor suite to beat the broad US equity market’s returns over the 10 years from 2015 through 2024. Alphabet GOOGL and Meta META were key contributors. Like other members of the “Magnificent Seven,” these are companies that symbolize a “winner-takes-all” era. To some, they are monopolists. Meta, as well as other quality stocks like Amazon.com AMZN and Nvidia NVDA, have also contributed to the success of the Morningstar US Momentum Factor Index, which is the only other market-beating factor index since 2015.

Quality stocks can become overvalued, though. In 2023-24, enthusiasm for artificial intelligence sent the Morningstar US Quality Factor Index to a 77% cumulative gain, topping the market’s 59% advance. At the start of 2025, valuations for US stocks were described as “stretched” in the words of Morningstar’s chief US market strategist Dave Sekera. Nvidia was among the quality names looking rich.

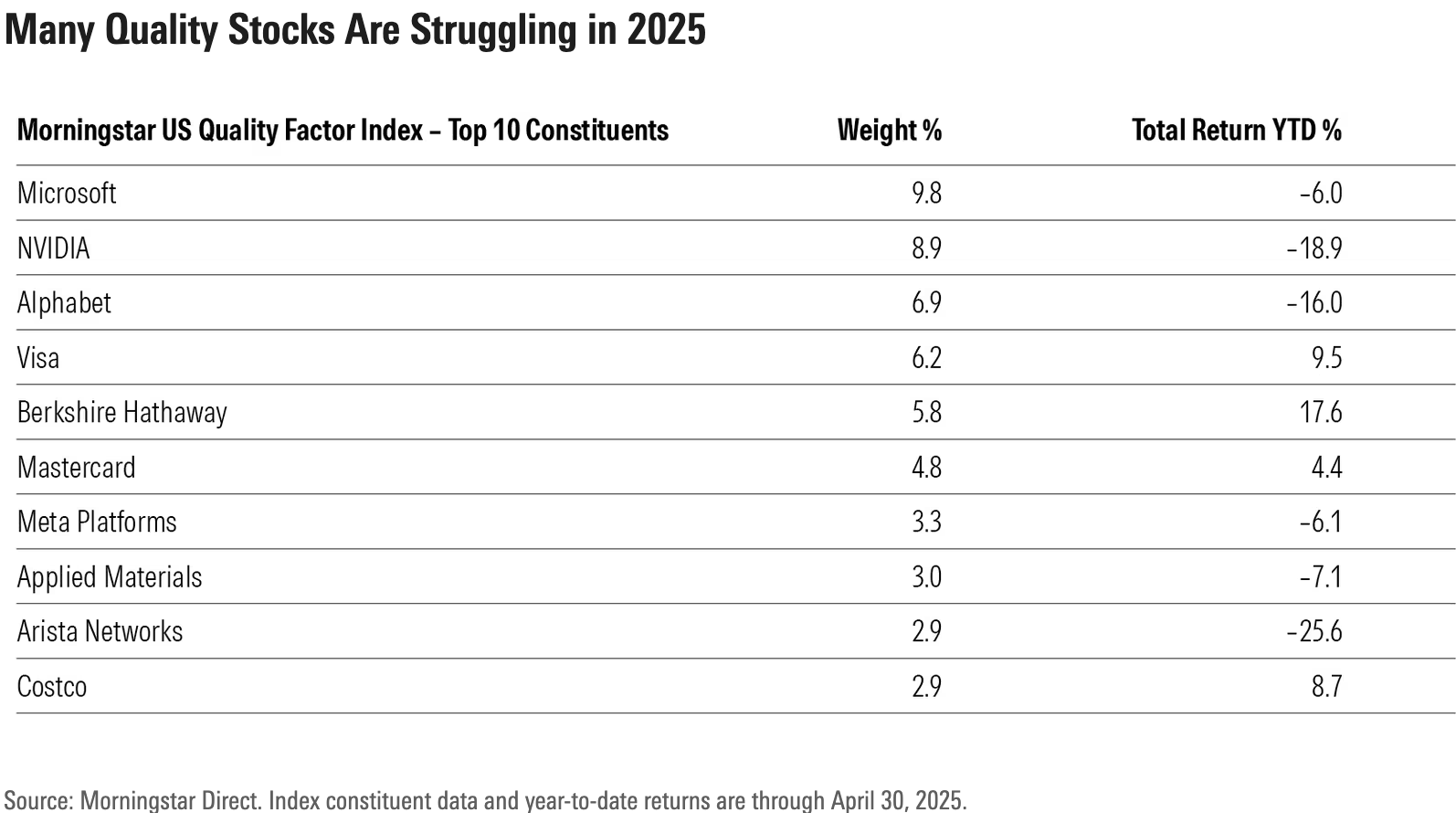

In that sense, it’s not super surprising that quality stocks disproportionately switched from “risk on” to “risk off” in 2025. When selloffs come, it’s often the highflyers that have the furthest to fall. Each of the quality index’s top 10 constituents has a unique story. But the net result has been deeper losses than the market. Meanwhile, some previously underperforming factors like low volatility, value, and yield have held up better.

(As for momentum, chasing performance can work—until it doesn’t. In his more sophisticated analysis, Bryan stated that, “Momentum has historically tended to struggle in periods of high market volatility, as performance leadership is less likely to persist when the market changes direction.” In the above table of factor index returns, you can see other years in which the momentum factor index was tripped up by rotations—2016 and 2023 jump out.)

Quality at the Right Price

Even the best asset can be a poor investment if you overpay. That’s certainly the view of Morningstar’s research and investment teams, which see valuation as critical. Morningstar equity analysts estimate fair values for the companies they cover through a discounted cash flow model and advocate buying when a company’s stock price trades at a discount to fair value.

Quality is a key input to their model, but it’s defined through the Morningstar Economic Moat Rating, as opposed to historical ratios like return on equity or debt/capital. Analysts assign moats to companies they believe are competitively advantaged. A business with a wide moat is expected to sustain profitability for 20 years, while a narrow moat should endure for 10 years. Most businesses have no moat.

The Morningstar Wide Moat Composite Index, which includes US companies that analysts see as most competitively advantaged, lost more than the broad equity market in the first four months of 2025. Some of its detractors, like Alphabet and Nvidia, overlap with the quality factor index’s constituent roster. Others, like Apple AAPL and Amazon.com, are seen to have wide moats but do not merit inclusion in the quality factor index.

What about wide-moat companies that are attractively valued? The Morningstar Wide Moat Focus Index tracks companies that earn moat ratings of wide and whose stocks are trading at the lowest current market prices relative to fair value estimates. Index returns are in line with the market for 2025 but ahead over the past decade. Losers this year include Zimmer Biomet ZBH and Disney DIS, while Corteva CTVA and Veeva Systems VEEV have been winners.

Bets against the market require patience. That’s true both of a forward-looking approach like the Wide Moat Focus Index and a factor-based one like quality investing. The above factor performance table demonstrates that market leadership is changeable. Just because quality has been a winning investment strategy in recent years does not mean outperformance will persist.

The Morningstar Factor Indexes were launched in January 2023 with returns backcast to 2008 based on a methodology derived from the Morningstar Risk Model.

©2025 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.