The Takeaway

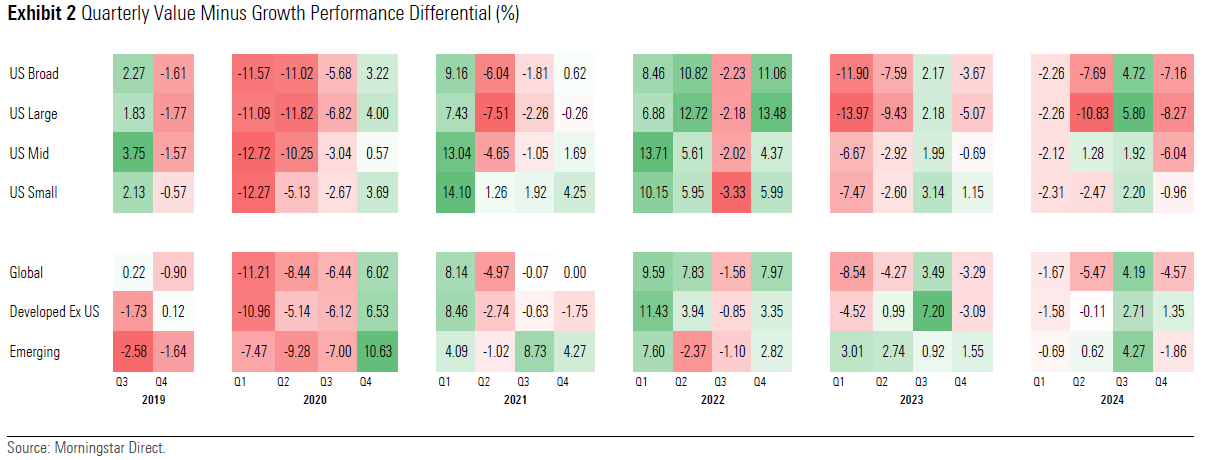

Globally, markets delivered divergent returns, with US markets ending the quarter in positive, while the broad markets outside of the US, including their style variants, closing in negative. Contrary to the last quarter, growth style regained its dominance over value, with growth outperforming value in US markets and emerging markets, while marginally underperforming value style in developed markets outside of the US.

Volatility was pronounced in growth stocks relative to value stocks over the past quarter for developed markets, including the US. Overall, compared with the third quarter, short-term volatility cooled off across the board for the latest quarter.

Valuation spreads between growth and value stocks, measured by P/E (trailing 12 months), increased over the past quarter for US large, small, and developed-markets ex-US segments, while easing a bit for US mid- and emerging markets. As of December 2024, the growth-value P/E spread continued to be in the top quartile of historical distributions for all size bands and regions.

The fourth quarter of 2024 witnessed a contrasting performance between the US markets and the markets outside of the US. The presidential election outcome, federal-reserve rate cuts, and healthy economic growth on the back of strong consumer spending helped the Morningstar US Market Index close the year with 2.6% returns for the latest quarter ending December 2024. Growth stocks, after taking a backseat amidst a turbulent third quarter, continued to extend their dominance over value stocks. The Morningstar US Broad Growth Index delivered 6.3%, while its value counterpart lost 0.9%. The large-cap growth was the best-performing size segment delivering a solid 7.6% return, with leading contributors to its outperformance suggesting that artificial intelligence enthusiasm has not waned off, particularly as Nvidia gained 10.0% after a sluggish third quarter.

©2025 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.