The Takeaway

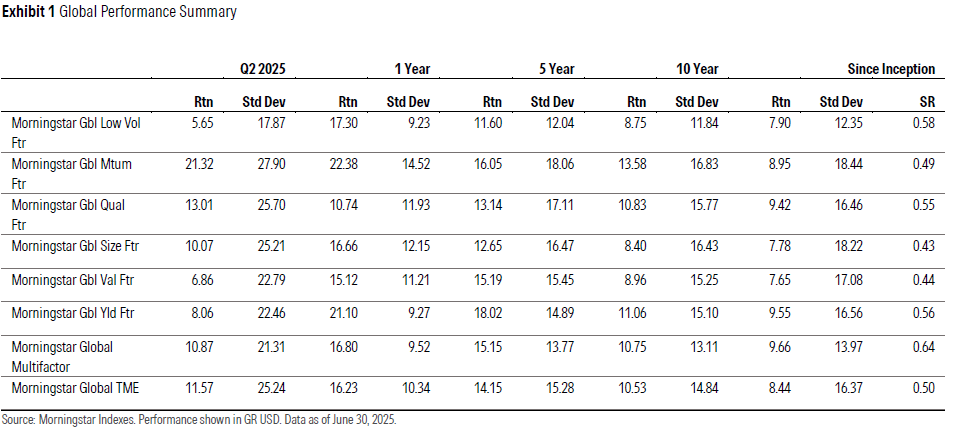

In a reversal from the previous quarter, momentum dominated globally in Q2, while the low volatility factor lagged. Value and yield also underperformed globally.

The momentum and low volatility indexes had the highest turnover at the June 2025 reconstitution, with the Morningstar Global Momentum and Morningstar Global Low Volatility Indexes both trimming their exposure to the technology sector.

Factors are lowly correlated with each other, so they are complementary and can offer strong diversification benefits when combined in a portfolio.

Factor performance in the second quarter of 2025 was markedly different from the results in the first quarter. Momentum led the pack by a wide margin, while low volatility and value were the worst performing factors globally. The yield factor also struggled during this period. That's in sharp contrast to the first quarter results, when momentum was the second worst performing factor globally (after quality) and the defensive low volatility and yield factors led.

This reversal in performance isn't surprising considering how different the market environment was in the second quarter compared to the first. While the market had been anticipating a rise in protectionism, the risk became more tangible when the US government announced a new series of tariffs on April 2, 2025 ("Liberation Day"). This, and the subsequent pause on certain tariffs, created significant uncertainty, elevating market volatility. Yet, despite the uncertainty, stocks rallied toward the end of the quarter, in contrast to the weak performance of the Morningstar Global Target Market Exposure (TME) Index in Q1 (-1.25%).

The heightened volatility of the second quarter makes the strong performance of the momentum factor even more remarkable. Momentum often struggles during periods of market turbulence or sharp reversals, as market leadership is more fluid in those environments. Yet, momentum topped the leaderboard in every region covered in this report in Q2.

Value and momentum tend to perform well at different times, so it's not surprising to see value toward the bottom of the leaderboard in a period where momentum is at the top. The Morningstar Global Value Factor Index was primarily hurt by poor stock exposure within sectors, rather than from sector tilts, which are tightly constrained relative to the parent benchmark.

The defensive low volatility factor posted even lower returns during the second quarter, as it often does when the market moves sharply higher. However, it lived up to its name, delivering a smoother ride than the market and any other factor during the turbulent quarter.

©2025 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.