The Takeaway

Higher interest rates aren't necessarily bad for growth stocks.

Economic growth and recovery don't always boost small caps.

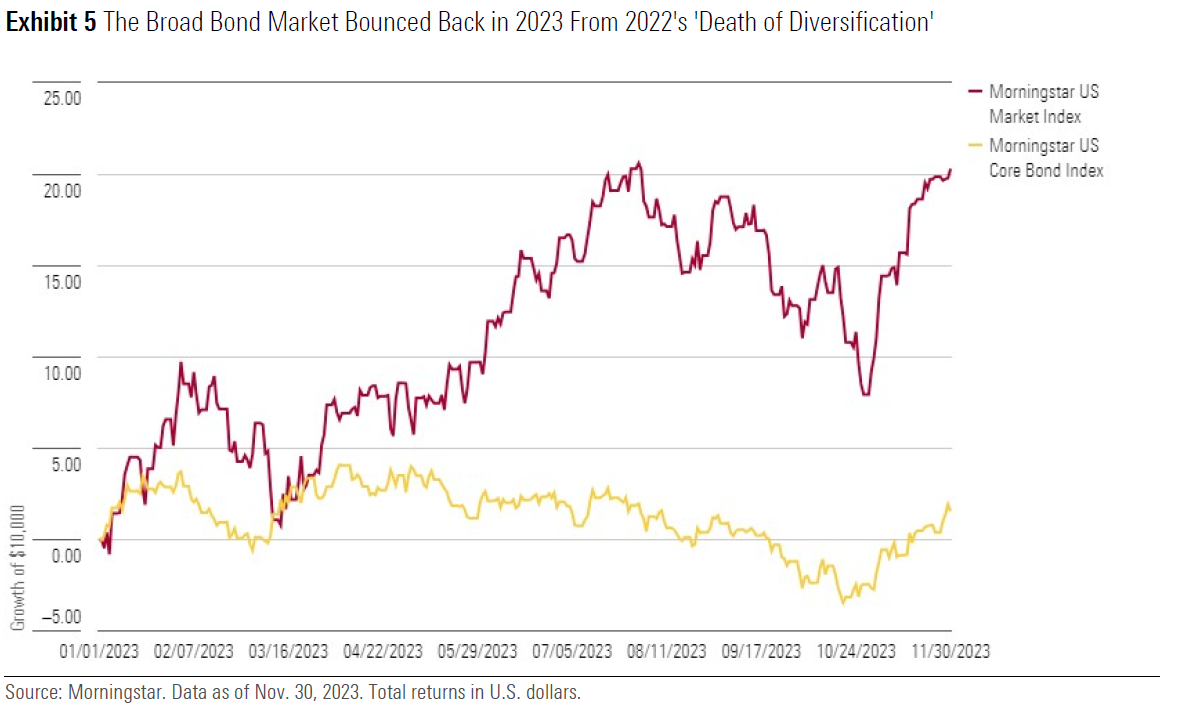

Bonds sometimes diversify equity risk and sometimes don't—and fixed income isn't a monolith.

In Star Wars: The Empire Strikes Back, Yoda told Luke Skywalker, "You must unlearn what you have learned." Investors would do well to heed the Jedi master's invocation to abandon preconceived notions. As 2023 draws to a close, we reflect on a year filled with unforeseen events and common assumptions overturned. To be fair, that describes most years.

When 2023 began, economists were debating whether the United States would experience a hard or soft landing with inflation raging and the yield curve inverted. Yet, by the third quarter of the year, gross domestic product was expanding by 5%. On the flip side, China's much anticipated postpandemic economic recovery didn't materialize, giving way to concerns over "Xi's failing model." The Israel-Hamas War was as unexpected as Russia's invasion of Ukraine in 2022.

Investment markets were also full of surprises in 2023. Equities rebounded impressively from a miserable 2022, and Japan came to life. Tech-related growth stocks resumed market leadership. Meanwhile, investors lured into fixed income by high yields and the promise of falling rates were met with borrowing costs that promised to stay "higher for longer."

Investors should be skeptical of conventional wisdom. Uncertainty surrounds the forces that move markets, how assets interact, and which investments best suit the macro environment. Rules of thumb about investing are hardly the immutable laws of physics.

©2023 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.