The Takeaway

The market is going to fluctuate.

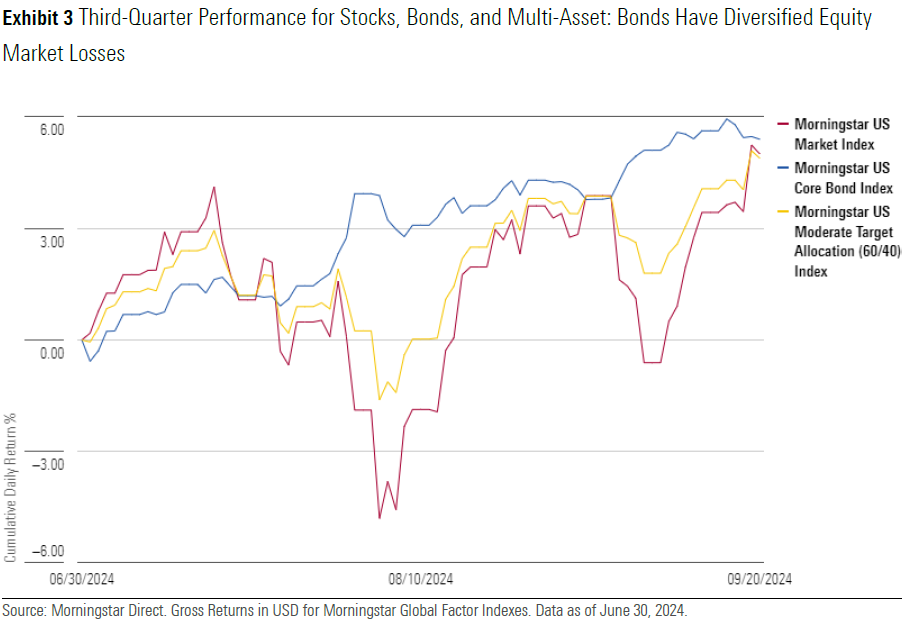

Diversification isn’t dead.

There is nothing permanent except change.

Will third-quarter 2024 stock market volatility register as a mere blip on investment growth charts? Or will it be remembered as an inflection point? Only time will tell who's right: bears heralding the bursting of the artificial intelligence bubble or bulls who say the market is just "climbing a wall of worry." Pessimism tends to sound smarter. But it's the optimists who've been repeatedly vindicated in recent years.

What's clear is that the cycle of greed and fear has been turning. AI enthusiasm, which pushed the Morningstar US Market Index to a 44% gain from the start of 2023 through the midway point of 2024, gave way to jitters over the economy and equity prices. Jobs reports, inflation prints, and earnings announcements caused selloffs. Both an unexpected interest-rate hike by the Bank of Japan and an expected rate cut by the US Federal Reserve contributed to volatility.

Though equities have ridden out the bumps to post healthy gains this year, signs of change are visible beneath the surface. Value stocks are beating growth in the third quarter. Small caps have rallied. The Morningstar Global Markets ex-US Index is even with its American counterparts in dollar terms since July 1. High-quality fixed-income assets have thrived. The Morningstar US Core Bond Index is up more than 5% in the third quarter.

©2024 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.