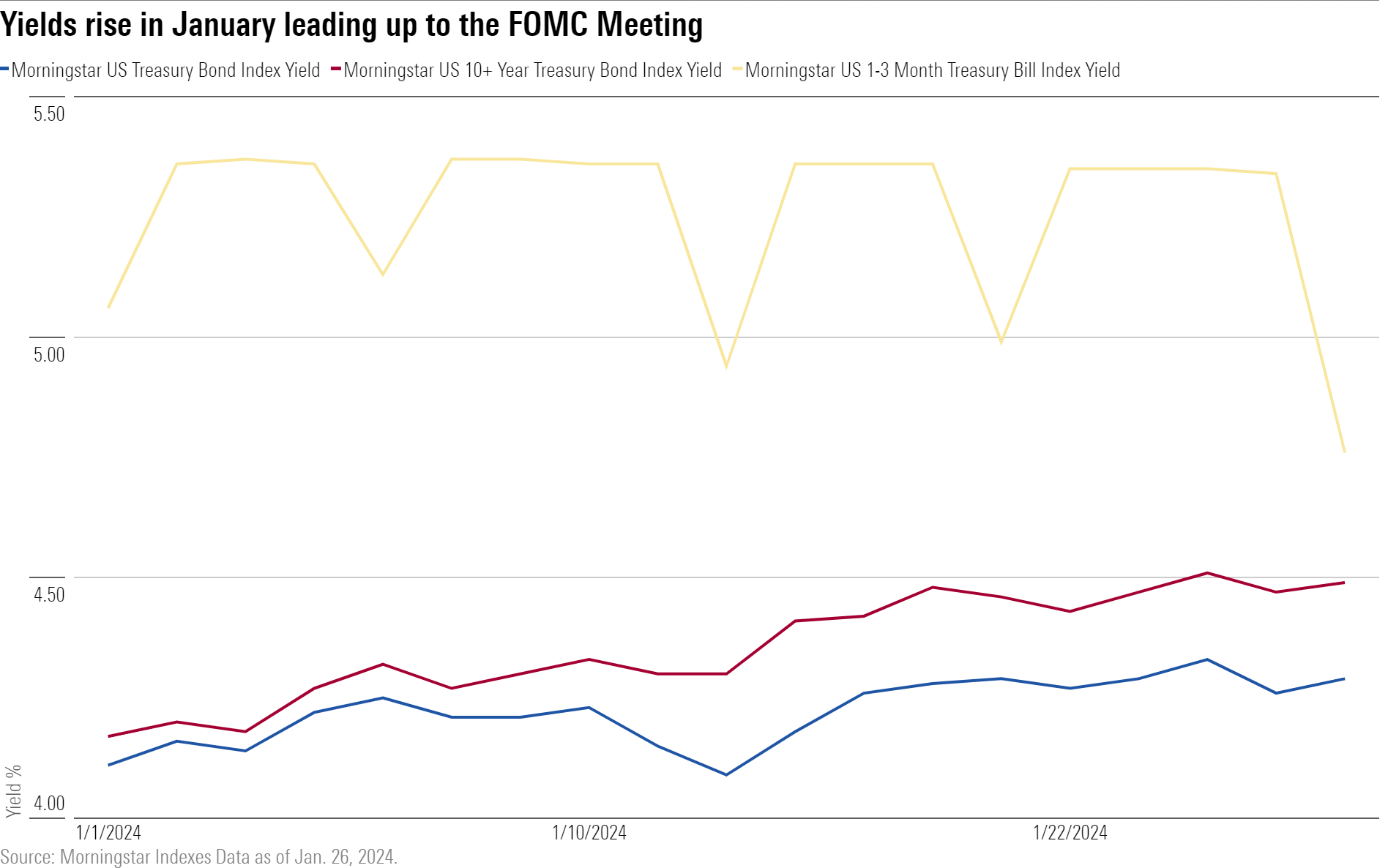

While investors expect the Fed to hold interest rates steady for the fourth consecutive time this week at their first FOMC meeting of 2024, markets have been anything but steady. The market optimism at the end of 2023 has waned in January amid mixed signals from recent CPI and PCE figures. The result has been a volatile bond market as investors question the timing and frequency of Fed rate cuts in 2024.

With the upward shift of the yield curve in January, the Morningstar US Treasury Bond Index has lost 1.2% in January, while the yield of the index has climbed 13 basis points to 4.3%. Meanwhile, the 10-year US Treasury bond, often viewed as a signal of longer-term investor confidence and rate expectations, has declined sharply, with a 4.5% loss for the Morningstar US 10+ Year US Treasury Bond Index in January. Investors have found some safety in ultra-short term bonds, with the Morningstar 1-3 Month Treasury Bill Index one of the few fixed income asset classes in positive territory so far in 2024.

Katie Binns – Director of Fixed Income & Multi-Asset Indexes, Morningstar Indexes

“The Fed is gearing up for its biggest balancing act yet. The risk of keeping rates too high for too long is being weighed against the risk of making a move too soon and seeing inflation rebound. For the January meeting, investors will be looking for signs on the timing of a pivot from the Fed’s currently restrictive stance.”

©2024 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.