Artificial intelligence, or AI, has been a key driver of market returns in 2024, as evidenced by an 18.4% year-to-date (as of Sept. 10) rise for the Morningstar Global Next Generation Artificial Intelligence Index. This index provides exposure to leading-edge companies delivering artificial intelligence and adjacent products and services by drawing on the insights of Morningstar’s global equity research team. This performance compares to 15.1% and 12.9% returns for the Morningstar US Market Index and Morningstar Developed Markets Index, respectively.

However, recent turbulence for Nvidia and other “Magnificent 7” stocks may lead some investors to question the durability of the investment case for AI.

Despite recent volatility for AI stocks like Nvidia, Morningstar equity research reflects a positive view on AI’s longer-term prospects.

Brian Colello – Equity Strategist, Morningstar Equity Research, said:

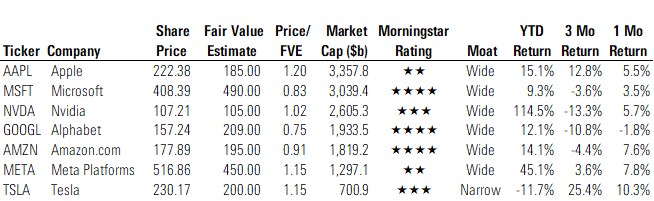

“Despite the recent short-term market volatility for AI and AI-related players like Nvidia, which we see as a welcome pullback in many respects, we’ve seen little to no fundamental slowdown in AI build-outs in the past few months. In fact, our latest comparison of share price-to-fair value estimates for the Magnificent 7 stocks shows a reasonable valuation picture for this cohort. We believe AI adoption will keep moving full steam ahead, as large cloud players like Microsoft, Google, Amazon, and Meta have indicated that they will continue to materially increase their AI investments.”

AI Turbulence & Fair Value Estimates for Magnificent 7: Morningstar Equity Research

Source: Morningstar Equity Research. US dollar total returns as of Sept. 4, 2024. Past performance is no guarantee of future results.

A variation of the Morningstar Global Next Generation Artificial Intelligence Index serves as the basis for an index-based exchange-traded fund, or ETF, offered by iShares, which provides investors with thematic exposure to AI and AI-related stocks.

Jay Jacobs – US Head of Thematic and Active ETFs, BlackRock iShares, said:

“As AI brings new efficiencies and revenue opportunities to virtually all segments of the economy, many investors are looking to get more granular exposure in their growth bucket to harness this theme's long-term potential.”

©2024 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.