Traditional approaches to portfolio diversification don’t always work the way investors might anticipate, according to new insights based on Morningstar Indexes.

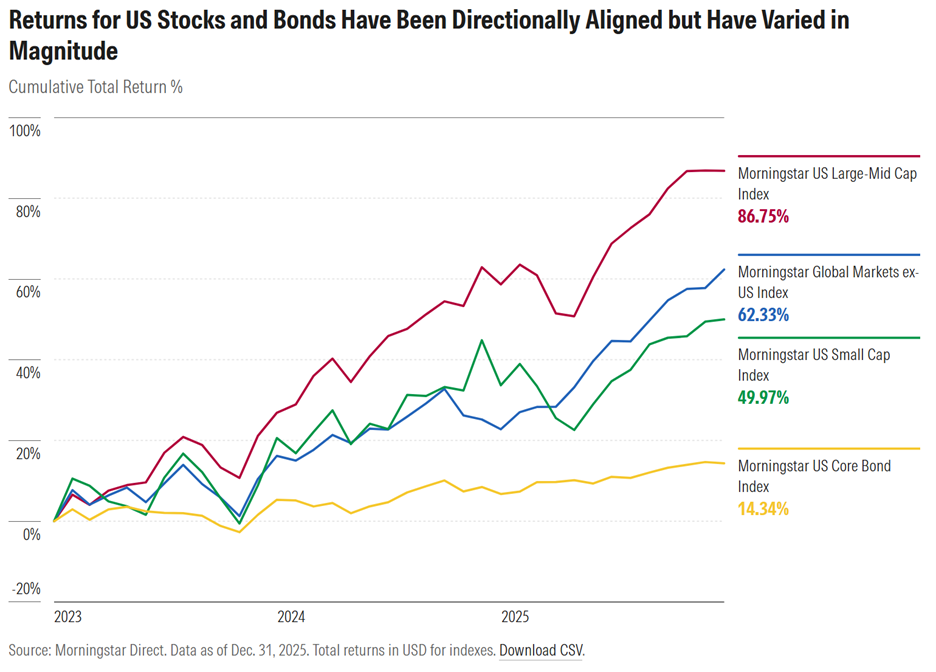

In fact, four basic portfolio building blocks ― US larger stocks, US small caps, international stocks, and US bonds ― have provided some diversification benefits over the past few years while being positively correlated with each other, flying in the face of conventional wisdom about diversification through negative asset class correlation.

In his recent article ― Why Portfolio Diversification Is About More Than Just Correlations ― Morningstar Indexes Strategist Dan Lefkovitz provides examples of when asset classes performed in both unexpected and expected ways:

- US fixed income, as represented by the Morningstar US Core Bond Index, performed the ways bonds are expected to perform during rocky times for US equities, offsetting negative equity returns during stock market panics in 2025, 2020, 2008, 2002, and 2000. Yet bonds fell along with stocks in 2022, amid rising inflation and interest rates.

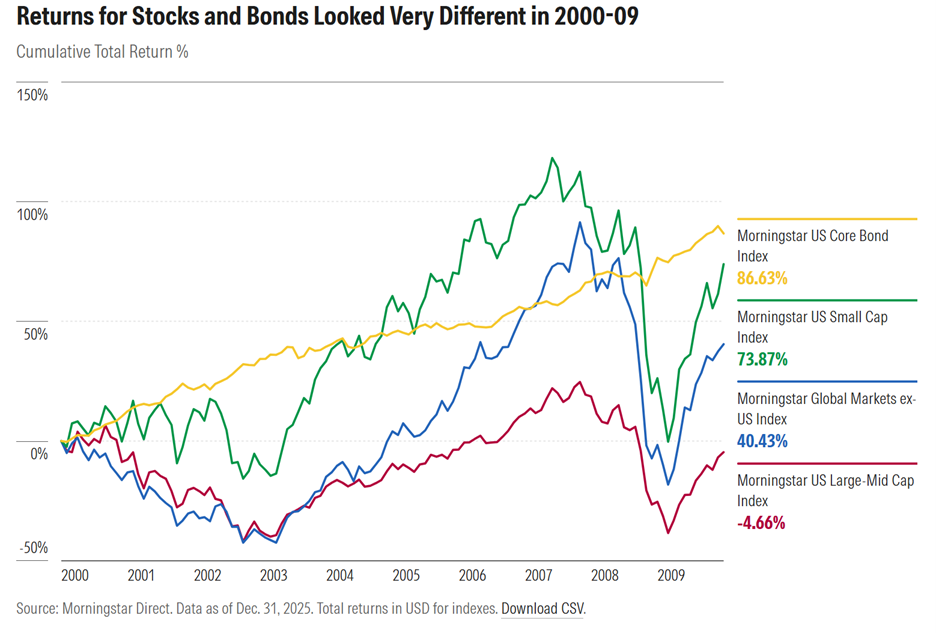

- In the first decade of the millennium, 2000–2009, a difficult one for US stock investors, bonds actually outperformed equities. US small caps and international stocks beat larger US stocks by a wide margin. Unlike our current market environment, investors holding international and small-cap stocks performed better than those who were just invested in the top of the market.

Dan Lefkovitz – Strategist, Morningstar Indexes:

“Investment leadership is changeable and the relationship between asset classes is fluid. Investors diversifying their portfolios should remember that asset correlations of recent years may not persist. Bonds are capable of beating stocks over certain periods, and let’s not count out small caps and international stocks, which have led in certain periods. It’s important for investors to understand that portfolio diversification is about more than looking at recent correlation data.”

©2026 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.