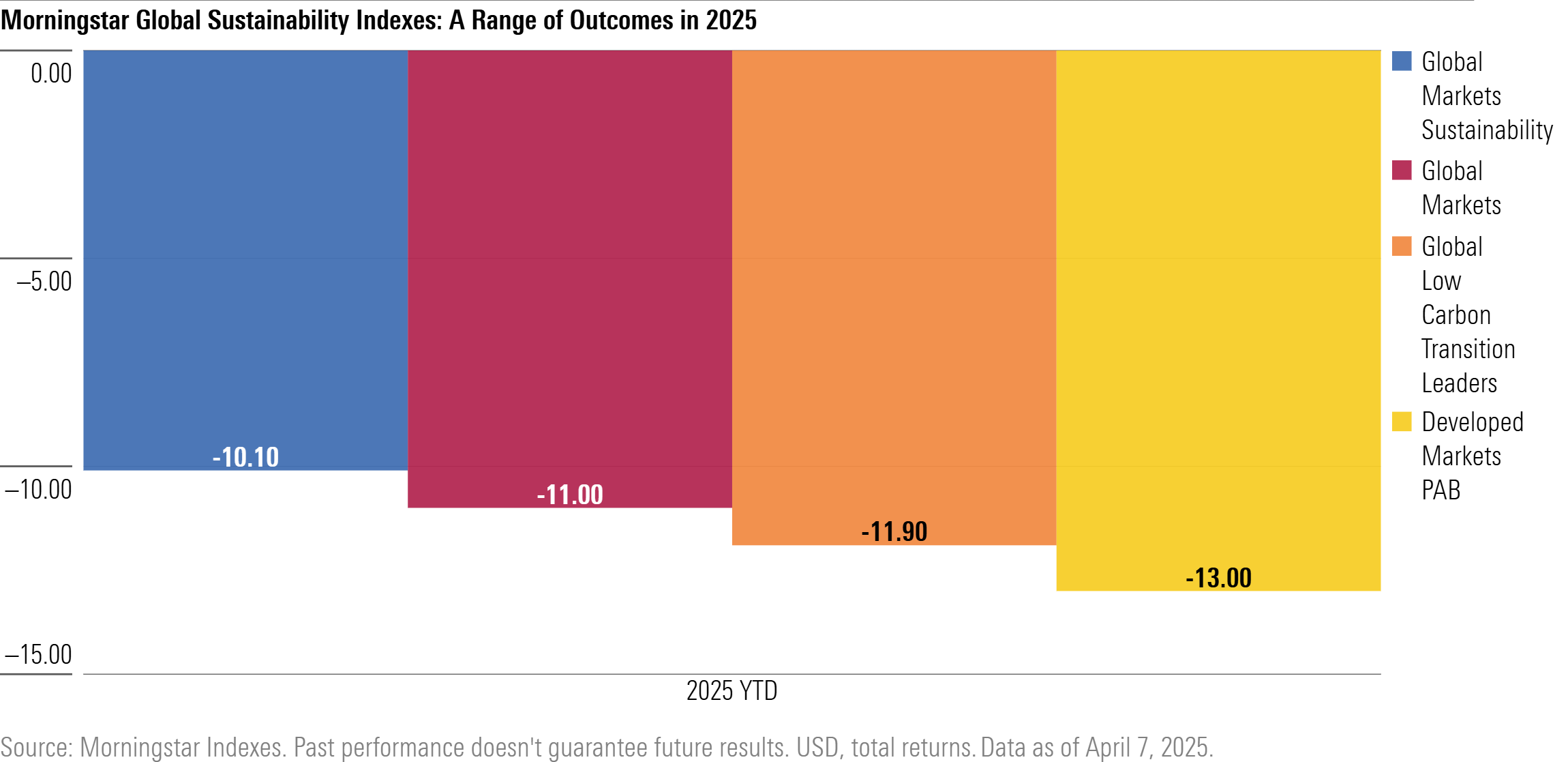

Global sustainability indexes have delivered a range of performance outcomes in 2025, according to new analysis from Morningstar Indexes based on its suite of global sustainability indexes.

In an environment of heightened market volatility and widespread uncertainty, which has seen the Morningstar US Market Index dip by 14% and the Morningstar Global Markets Index decline by 11%, the Morningstar Global Markets Sustainability Index has lost less than the broad global equity market, with a decline of just over 10%. The Morningstar Developed Markets Paris Aligned Benchmark (PAB) and Morningstar Global Low Carbon Transition Leaders Indexes, on the other hand, have both lost more than the broad market, declining 13% and 12%, respectively, in 2025.

Morningstar Index experts attribute the ability of the Morningstar Global Sustainability Index to better weather the current market storm to its underlying methodology.

Thomas Kuh, PhD, Head of ESG Strategy – Morningstar Indexes

“Not all ESG indexes are created equally. Different objectives lead to different methodologies and, potentially, different outcomes for the end investor. The Morningstar Global Sustainability Index is designed to offer broad market exposure with lower relative ESG risk than the broad market. Stock selection in communication services and consumer cyclicals has helped its year-to-date performance relative to the market benchmark.”

Kuh goes on to describe that the Morningstar Global Sustainability Index has lower downside capture ratio and higher upside capture ratio than the broad market. This means the index has a propensity to lose less in times of market stress and gain more in times of market growth.

©2025 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.