The traditional 60/40 stock/bond portfolio has long represented a happy medium for investor asset allocation and a way to potentially cushion a portfolio from market downturns. The long-held logic behind the 60/40 portfolio contends that, over time, stocks and bonds tend to move in opposite directions.

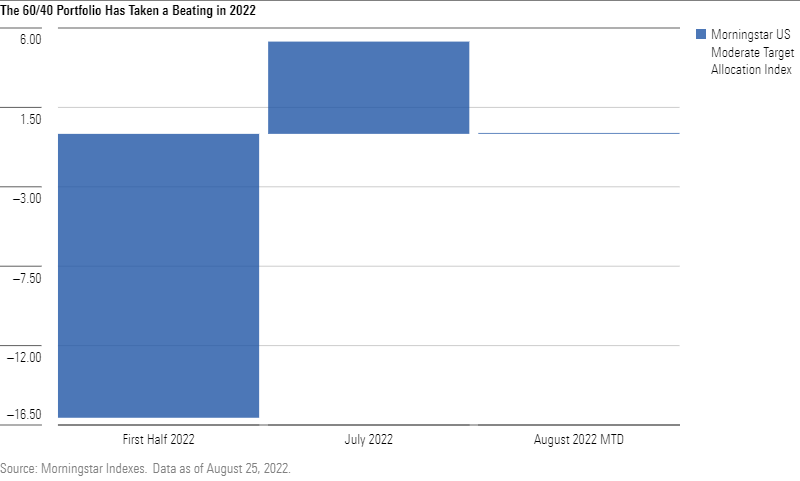

Yet in 2022, as stocks and bonds have broadly moved in the same direction, the 60/40 portfolio has taken a beating, with the Morningstar US Moderate Target Allocation Index down more than 16% through June 30.

The second half of the year has appeared to bring a comeback for 60/40, with the index rebounding amid rebounding investor optimism, rising more than 5% in July and August. Yet much of these gains occurred in July and the index has been flat thus far in August.

Will the 60/40 portfolio make a comeback in the second half of 2022? As investors digest Fed Chair Jay Powell’s message from his addresses today at the annual Jackson Hole global central banking conference, much of the answers will lie in the broader markets and economy, according to Katie Binns, Director of Fixed Income and Multi-Asset Indexes at Morningstar.

“The 60/40 balanced portfolio has certainly disappointed investors who typically leverage this strategy to balance needs for growth and wealth preservation in times of economic downturn. And after a July bounce back in this strategy driven by increased investor optimism, we seem to be headed in the wrong direction yet again. Where we go from here really depends on how Chair Powell’s remarks are received as well as what the data tells us, with recent downbeat economic reports, continued warning signs, persistently high inflation and an inverted yield curve building a strong anti-comeback case. Regardless of short-term market trends, however, a well-diversified multi-asset approach can certainly benefit investors over the longer term.”

For more analysis on the state of the 60/40 portfolio in 2022, you can check out Morningstar analyst Lauren Solberg’s recent article – Why Your 60/40 Balanced Portfolio Isn’t Working in 2022.

To speak with Katie Binns, reach out to Tim Benedict at tim.benedict@morningstar.com or (203) 339-1912.

©2022 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.