Investors who shifted away from the AI trade and toward the health care sector and certain industrial and broad-based technology names were rewarded in the fourth quarter as AI-driven technology stocks underperformed, according to new insights from Morningstar based on the Morningstar Wide Moat Focus Index.

In fact, the index, which represents a basket of undervalued US stocks with wide economic moat ratings as determined by Morningstar Equity Research, rose 6.0% in the fourth quarter as compared to a 2.4% rise for the Morningstar US Market Index, a broader benchmark representing 97% of the US investable market. This trend has continued into the new year, with the Wide Moat Focus Index up 1.9% year to date through January 20 versus a 0.3% decline for the US Market Index.

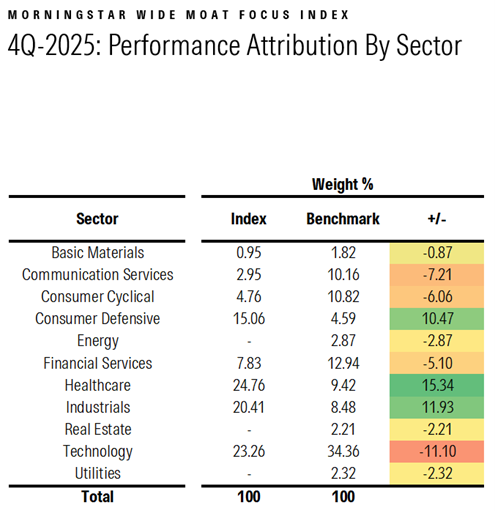

Morningstar experts attribute the outperformance of the Wide Moat Focus Index in recent months to its unique methodology that combines qualitative analysis with a valuation focus. This approach typically leads to notable overweight and underweight positions relative to broad market sectors and themes, which has boosted index performance in recent months as market participation has broadened beyond tech.

Stock selection within sectors has also played a role. Among the leading drivers of index return in the fourth quarter across the Healthcare, Industrials, and Consumer Defensive sectors were Merck & Co., Inc., Huntington Ingalls Industries, and The Estee Lauder Companies Inc., respectively. Technology names that are broader than AI pure plays, such as Teradyne and Applied Materials, also boosted index returns.

Brian Colello, CPA – Technology Equity Senior Analyst, Morningstar

“The Morningstar Wide Moat Focus Index, with its valuation focus and equal-weighting methodology, is underweight in Technology and overweight in Healthcare, Industrials, and Consumer Defensive stocks relative to the broad U.S. equity market. While these sector differences have weighed on index performance in recent years as AI-related Technology leaders have soared, they have helped boost index performance in the fourth quarter and thus far in 2026 as many large-cap AI stocks have taken a pause."

©2026 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.