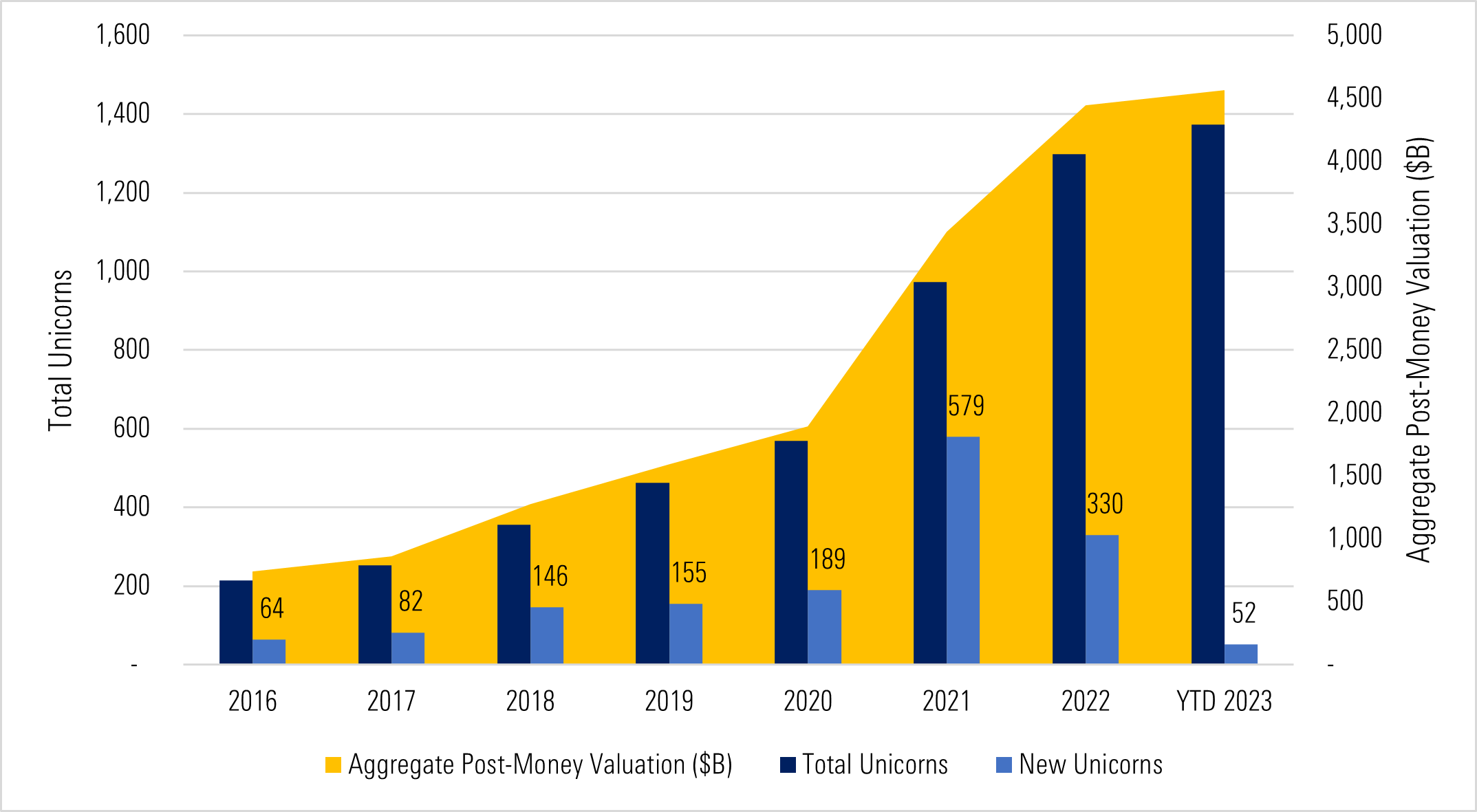

The rate of creation for new unicorns, or venture capital-backed companies with post-money valuations of $1 billion or more, has slowed considerably according to the latest quarterly reconstitution for the Morningstar PitchBook Global Unicorn Index.

During the third quarter, only eight private companies met Morningstar Indexes' criteria to be called a unicorn according to its proprietary valuation methodology. This brings the year-to-date count of new unicorns to 52. At this rate, 2023 will fall well short of the two previous years in terms of unicorn creation.

During the quarter, the three largest entrants into the Morningstar PitchBook Global Unicorn Index included:

- Hithium, a US-based Climate Tech company, raised $629M at a $4.19B valuation.

- Sky Mavis, a Singapore-based Gaming company, raised $11M at a $1.95B valuation.

- Cart.com, a US-based E-Commerce company, raised $60.5M at a $1.26B valuation.

There were 11 exits over the quarter. The largest exits from the index include:

- Huaqin Technology, a China-based Smart Hardware Manufacturing company, which IPO’d in August at an estimated valuation of $8.16B.

- Better, a US-based Real Estate Technology company, which exited via reverse merger in August at a valuation of $7.7B.

- Scopely, a US-based Gaming company, which exited via buyout in July at $4.9B.

Sandy Beharry, Morningstar Indexes Senior Product Manager:

“Despite a few recent successful IPOs that hint at a positive resurgence in deal activity, investors are still grappling with uncertainty regarding the future trajectory of the global economy and navigating a challenging macro environment. This has certainly impacted the number of companies attaining unicorn status.”

©2023 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.