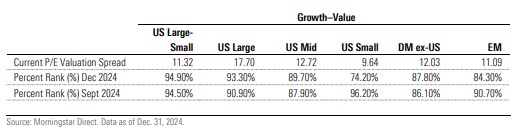

The valuation spread between growth and value-oriented indexes is near an all-time high, particularly in the US large-cap space, suggesting that value has some upside potential, according to the latest style analysis from Morningstar Indexes.

In the Morningstar Quarterly Style Monitor, published in January 2025, author Aniket Gor points out that valuation spreads—as illustrated by trailing 12-month P/E ratios—between growth and value indexes are in the top quartile historically for all global size tiers and regions.

The report goes on to share insights—utilizing data from the Morningstar Broad Style Index family—on the long-term relationship between valuation spreads and future returns for US indexes. Notably, wider valuation spreads have been associated with lower returns for subsequent five-year periods for the more expensive growth style relative to their value counterparts.

Aniket Gor – Lead Quantitative Analyst, Morningstar Indexes

“While the nature of our research into the potential direction of growth and value index performance is long term and difficult to predict in the near-term, it can be useful for investors to consider the growth-to-value valuation discrepancy in the context of the current market environment. A small handful of US large-cap growth stocks has driven market performance in recent years, but growing uncertainty around policy, interest rates, and geopolitics could be a positive for value-oriented stocks going forward.”

©2025 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.