Technology-oriented global companies, specifically those involved in AI-related initiatives, have helped drive growth of the 20 largest private companies in recent years and are creating additional opportunities for investors beyond public markets.

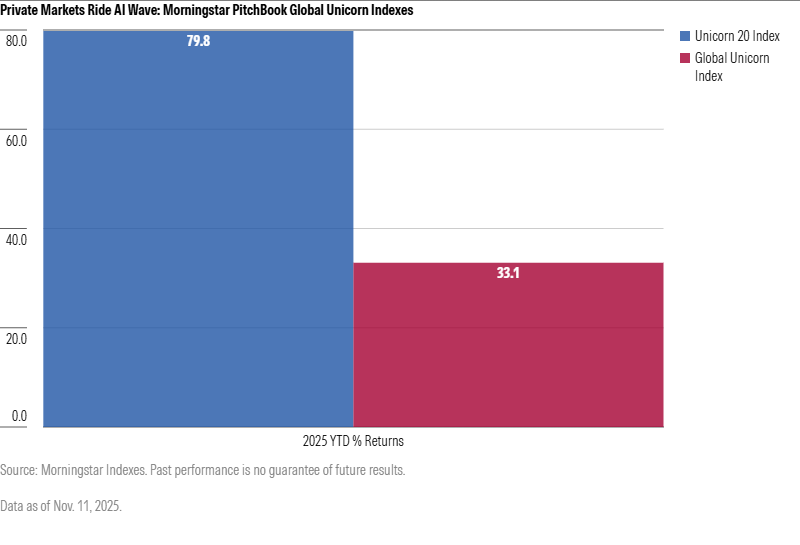

The Morningstar PitchBook Unicorn 20 Index (U120), introduced in September* and designed to represent the 20 largest constituents within its parent index, the Morningstar PitchBook Global Unicorn Index, has risen nearly 80% in 2025 as of November 11. This compares to a 33% year-to-date rise for its parent index and a 21.5% rise for the Morningstar Global Markets Index, tracking the global universe of publicly held stocks.

AI-oriented firms dominate the top holdings for the Unicorn Select 20 Index with Anthropic, xAI and OpenAI all included. Other household names including Kraken, Revolut, and SpaceX, are also featured. Leading names like these have helped the private market enter a new stage, with scale, liquidity, and transparency supporting index-based investing. Insights from Stableton demonstrate the opportunity:

- Scale: Over 1,350 unicorns now represent more than USD $4.7 trillion in combined valuation.

- Liquidity: Secondary market volume has surpassed USD $162 billion, improving price discovery and institutional access.

- Growth: These “private blue chips”—founder-led leaders in AI, fintech, space tech, and enterprise software—are generating 60%-plus annual revenue growth into 2025.

- Shift in value creation: With companies staying private longer, the majority of growth now occurs pre-IPO.

Andreas Bezner, CFA, Co-Founder and CEO of Stableton:

“The increasing scope of capital investment, innovation, and value creation among private technology-oriented companies presents a major opportunity for investors. Artificial intelligence, fintech, robotics, and other transformative technologies are playing a pivotal role in shaping the global unicorn market, an area investors are increasingly considering for portfolio diversification and potential returns. Indexes help bring the transparency and structure that investors expect from public markets, helping them navigate this dynamic private market landscape with confidence.”

Sanjay Arya, Head of Index Innovation, Morningstar Indexes:

“Indexes have long provided additional perspective and transparency to guide public market strategies, and now they are serving a similar purpose for private markets. Through our Morningstar PitchBook Global Unicorn Indexes, developed with our Morningstar colleagues at PitchBook, investors have a variety of transparent and investable benchmarks to measure a wide range of private venture-backed companies, markets, and strategies.”

*The Morningstar PitchBook Unicorn 20 Index was launched in September 2025 and serves as the foundation for the Unicorn Top 20 strategy from Stableton. since replacing a similar index on November 1. Performance data prior to the index launch date is hypothetical and not actual and past simulated or actual performance data is not an indicator of future performance results.

©2025 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.