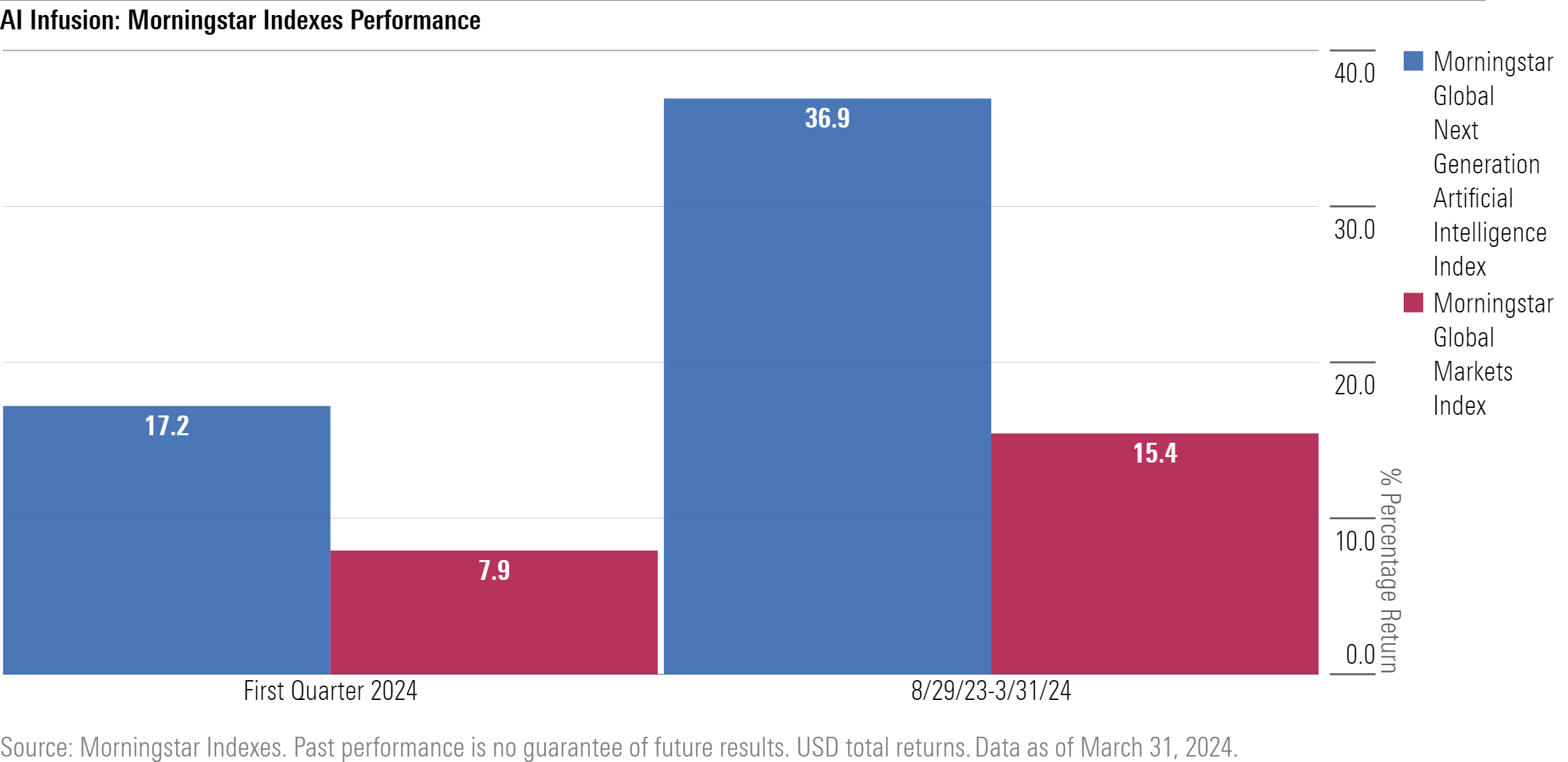

As the global equity markets conclude a strong first quarter, companies with exposure to artificial intelligence have continued to enjoy lofty returns. This dynamic is reflected by the impressive performance of the Morningstar Global Next Generation Artificial Intelligence Index. The index has risen nearly 37% since its August 29, 2023 inception date and is up more than 17% year-to-date through the end of the first quarter.

The Morningstar Global Next Generation Artificial Intelligence Index is a thematic index designed to deliver unparalleled, thematically pure exposure to leading-edge artificial intelligence technologies. Drawing on the in-depth knowledge and forward-looking insights of Morningstar’s equity research team, the index counts Microsoft, Nvidia and Meta Platforms among its top constituents. The index outperformed its parent the Morningstar Global Markets Index by nearly 10 percentage points in the first quarter.

Brian Colello, Technology Equity Strategist, Morningstar, said:

“We are seeing a historic rise in demand for artificial intelligence, or AI, accelerators, led by Nvidia’s data center graphics processing units, or GPUs. In recent quarters, Nvidia has reported staggering revenue growth, raised the bar for next quarter even higher, and then smashed through such rosy forecasts. We still see the world’s leading cloud computing providers, and even nation states, racing to buy enough GPUs to run generative AI for themselves and their customers.

We see few, if any, signs that AI investment is slowing down. If the global economy remains strong, we expect companies to invest in generative AI. If the economy weakens, we expect companies to invest because of the potential efficiencies gained by implementing AI.”

Andrew Lane, Director of Equity Research Index Strategies, Morningstar, said:

“Targeting 50 constituents, the Morningstar Global Next Generation Artificial Intelligence Index has benefitted from its exposure to a broad selection of thematically pure AI players. Aside from mega-cap holdings such as Microsoft, Nvidia and Meta Platforms, the index includes a number of smaller technology firms aiding in AI development, AI data and infrastructure companies, software vendors and AI service companies such as consulting firms.”

The Morningstar thematic index underlies a new ETF offered by Invesco Canada, introduced earlier this year.

Pat Chiefalo, Head of ETFs and Indexed Strategies, Invesco Canada, said:

“The Invesco Morningstar Global Next Gen AI Index ETF (INAI) has resonated with investors who are looking for capital growth potential through global companies exposed to the artificial intelligence (AI) theme. For this reason, INAI has seen early success as the purest AI thematic ETF in Canada. By tracking the Morningstar Next Generation Artificial Intelligence Index, Invesco is the only provider that can currently offer access to the companies anticipated to have significant economic benefits through the advancement of AI technology.”

©2024 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.