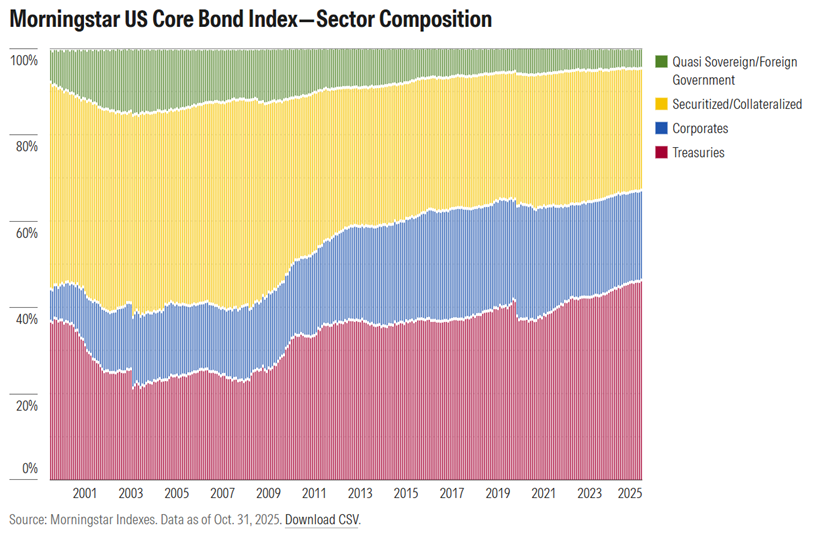

With all the concerns voiced by investors in the past year about a narrowing US equity market, dominated by a few AI-related technology players, investors may be overlooking a growing concentration in US fixed income, according to new insights based on the Morningstar US Core Bond Index.

In his recent article ― What a Treasury-Heavy Bond Market Means for Your Investment Portfolio ― Morningstar Indexes Strategist Dan Lefkovitz points out the growing share of Treasuries in the Morningstar US Core Bond Index and examines the potential implications for fixed income investors.

Notably, the share of US Treasuries in the index, which measures the performance of fixed-rate, investment-grade US dollar-denominated securities with maturities greater than one year, now sits at almost 47% of the index as compared to 36% a decade ago.

So, should fixed income investors be looking for ways to diversify away from Treasuries? Not necessarily, according to Lefkovitz, who cites rising yields for the Morningstar US Core Bond Index as a benefit that helps offset interest rate risk driven, in part, by a larger allocation to US Treasuries and corporate bonds. Other benefits to Treasuries right now include the potential for capital appreciation (the index has risen more than 7% in 2025) and diversification relative to US stocks.

Dan Lefkovitz, Strategist, Morningstar Indexes, said:

“A Treasury-heavy market is causing unease among many investors. Just as the rising share of technology and AI-related stocks has raised concerns of concentration risk in the stock market, fixed income investors worry about the impact of debt, deficits, and inflation. It may therefore seem like a no-brainer to get tactical and active with bonds. But it’s not that straightforward. While investors may be tempted to avoid Treasuries or stay in cash, this strategy includes opportunity costs.”

©2025 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.