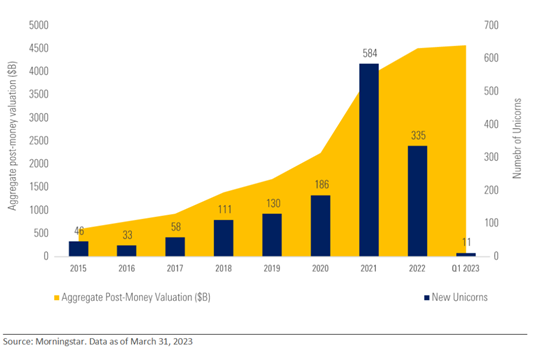

After a long period of flying high, venture capital backed companies with post-money valuations of $1 billion or more, otherwise known as Unicorns, came back to earth in the first quarter, according to the latest Morningstar Unicorn Market Monitor.

“After having the wind at its back for several quarters, the unicorn herd is now facing challenging headwinds,” said Morningstar Indexes Senior Product Manager Sandy Beharry. “There has been more deal activity in specific verticals such as Artificial Intelligence, however, the shortage of capital is a major concern for the late-stage market in 2023.”

According to the latest version of the quarterly commentary based on the Morningstar PitchBook Global Unicorn Indexes, unicorn fundraising hit a 21-quarter low in the first three months of 2023, with just $15.9 billion in deal value across an estimated 85 deals.

Down rounds, or funding rounds in which a company expects a lower valuation than it had on the prior round, are also up according to the monitor, with 19% down rounds in the first quarter relative to 11% in 2022, indicating many unicorns aren’t able to weather a challenging market.

©2022 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.Back-tested strategies are created with the benefit of hindsight. As such, the strategies do not represent actual index changes and may not reflect the impact material economic and market factors had on the decision-making process for an index. Back-tested performance is hypothetical in nature, does not reflect actual results, and does not guarantee future results. Hypothetical performance returns are theoretical and for illustrative purposes only. Future performance can differ significantly from the back-tested performance shown.

Morningstar indexes are created and maintained by Morningstar, Inc.Morningstar® is a registered trademark of Morningstar, Inc. PitchBook was acquired by Morningstar in 2016 and now operates as an independent subsidiary.